--- ### Quick Recap We're only a few lessons in and already we've covered some complex concepts, so let's do a quick recap of things we've gone over. ### Arbitrage  `Arbitrage` is the market correcting action of recognizing a difference in listed asset prices between exchanges and buying from one to sell on the other, ultimately profiting while normalizing the asset price. This is one of the major use cases for `flash loans`. ### Flash Loans  `Flash loans` are systems by which `liquidity providers` can loan out funds (for a fee) without collateral. **The loan must be paid back in the same transaction that it is taken.** `Flash loans` allow the average user to take advantage of much greater buying power than they would otherwise have - for that single transaction. If the loan isn't paid back within this transaction, everything is `reverted`. We outlined an example of this process in the diagram above! ### Wrap Up Tonnes has been covered already, but we've got lots more to do. Let's continue our recon in the next lesson!

Quick Recap

We're only a few lessons in and already we've covered some complex concepts, so let's do a quick recap of things we've gone over.

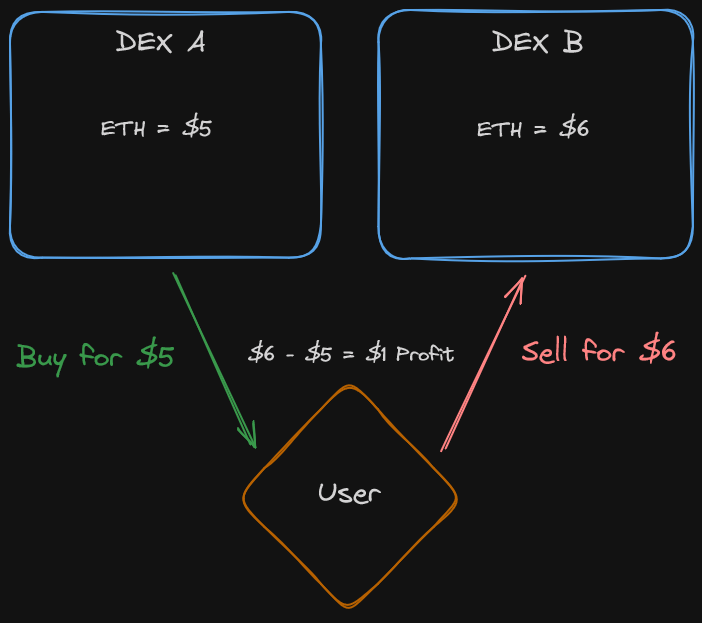

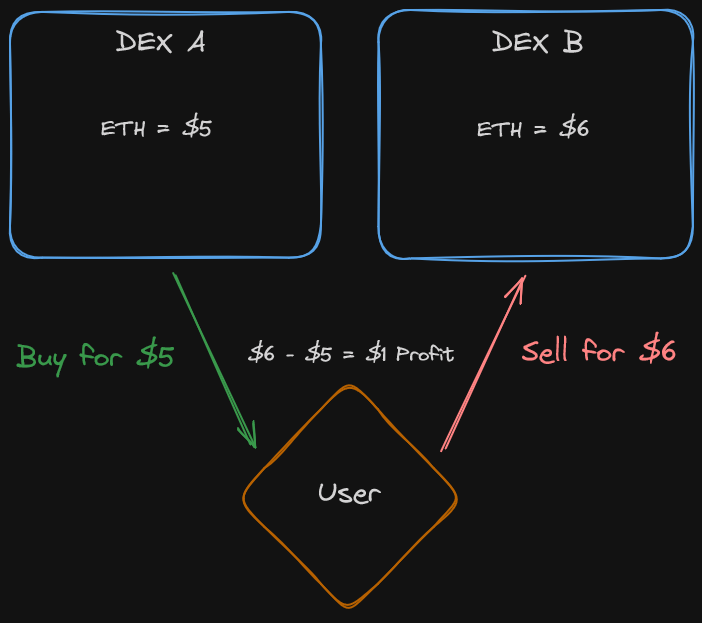

Arbitrage

Arbitrage is the market correcting action of recognizing a difference in listed asset prices between exchanges and buying from one to sell on the other, ultimately profiting while normalizing the asset price.

This is one of the major use cases for flash loans.

Flash Loans

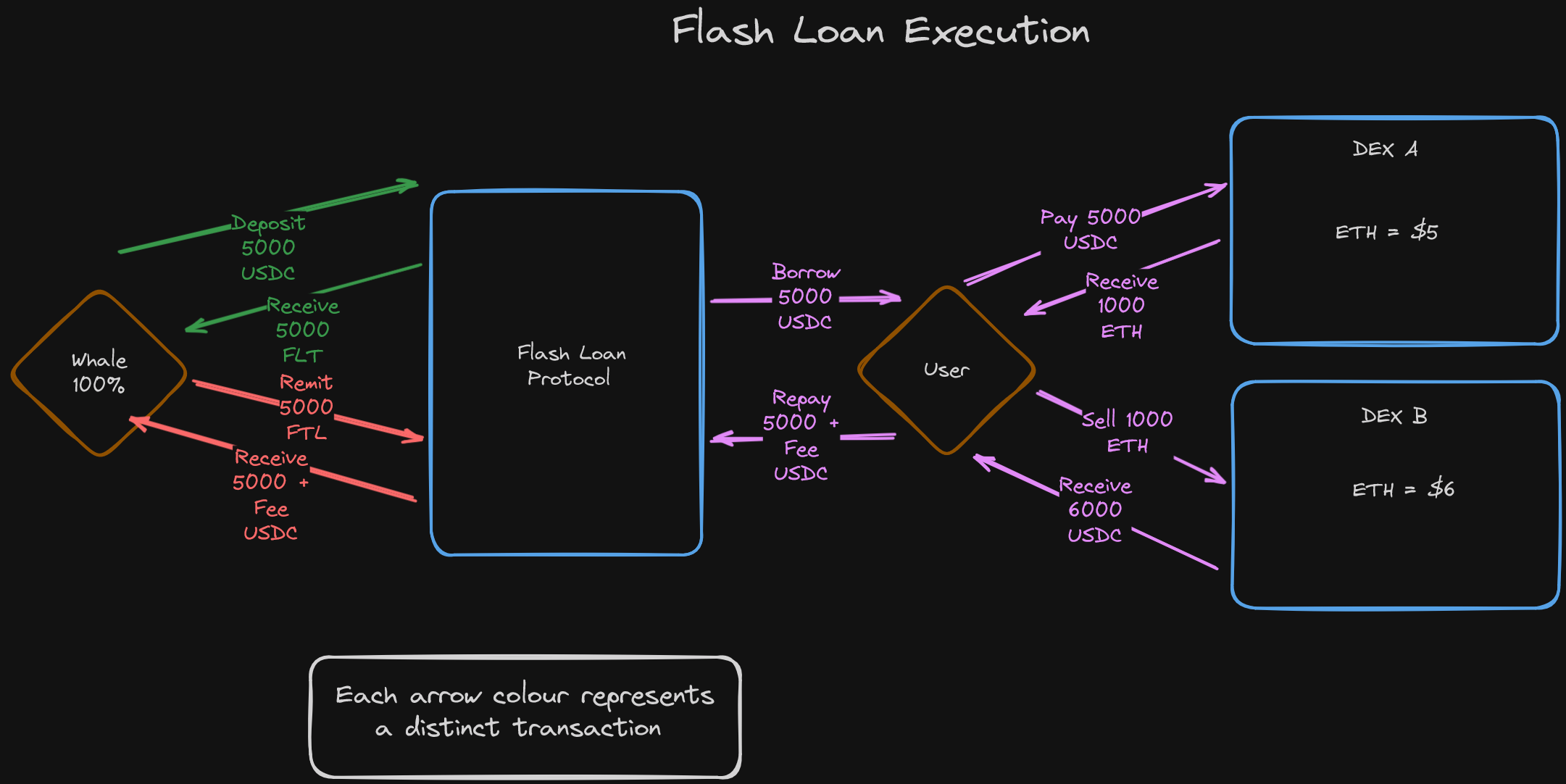

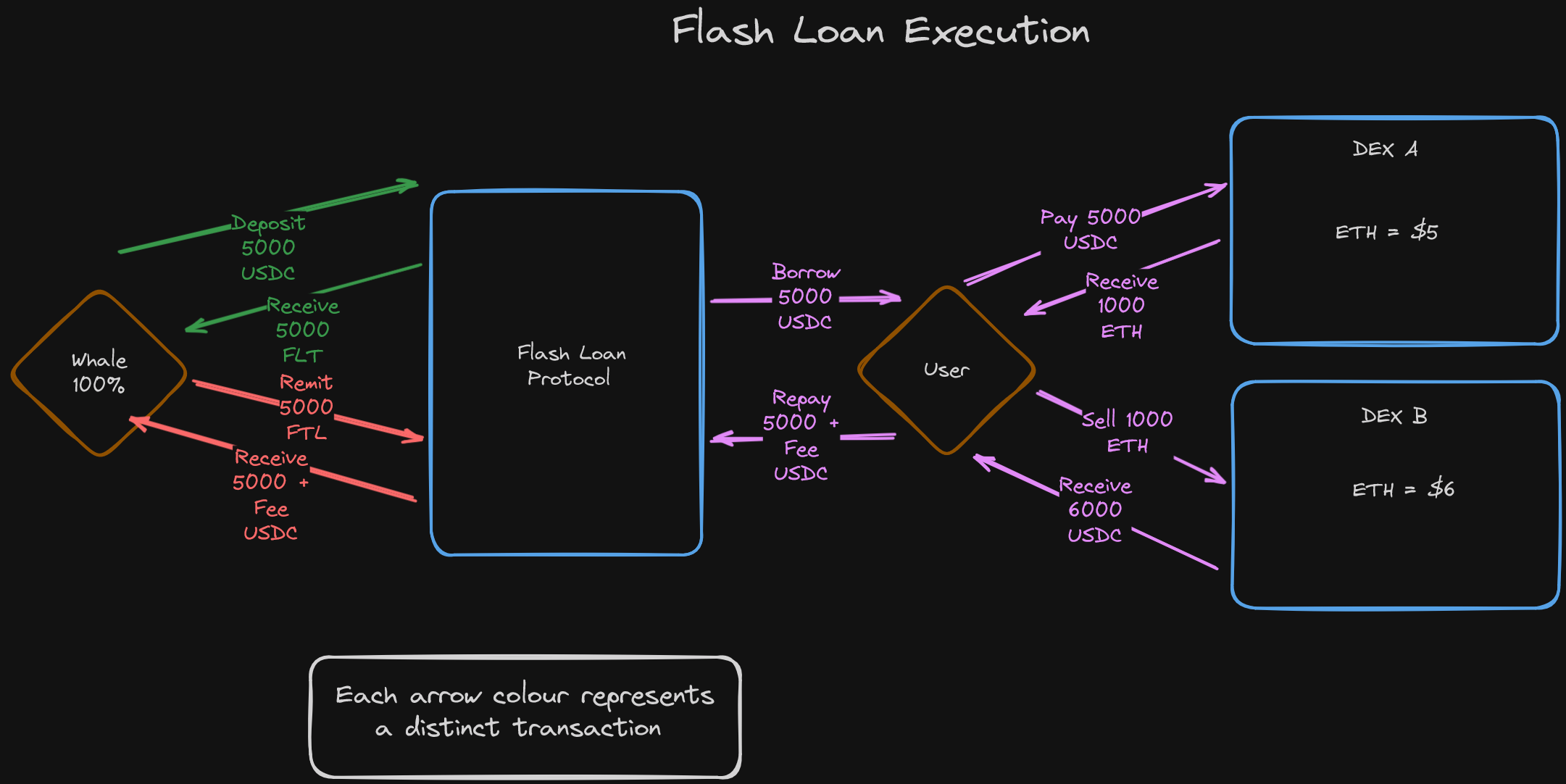

Flash loans are systems by which liquidity providers can loan out funds (for a fee) without collateral. The loan must be paid back in the same transaction that it is taken.

Flash loans allow the average user to take advantage of much greater buying power than they would otherwise have - for that single transaction.

If the loan isn't paid back within this transaction, everything is reverted.

We outlined an example of this process in the diagram above!

Wrap Up

Tonnes has been covered already, but we've got lots more to do. Let's continue our recon in the next lesson!

Recap

We're provided a summary of flash loans, arbitrage and how it all works in this recap of what we've just learnt.

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 30min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min