5/5

_Follow along the course with this video._ --- ### Handler - Price Feed Our handler looks great at this point, but it doesn't reflect everything. Another powerful feature of this methodology is that we're able to leverage our handler to guide not only our target contract, but any contract we want! Take price feeds for example. These are external references that our protocol depends upon to function properly. We can use our handler to more realistically emulate how price feeds would behave in real-world scenarios. Our project should already contain a MockV3Aggregator within the mocks folder, so let's begin by importing it into Handler.t.sol. This file mimics the behaviour of a price feed. ```solidity import { MockV3Aggregator } from "../mocks/MockV3Aggregator.sol"; ``` Then, we can declare a state variable, and in our constructor, we can employ another getter function to acquire the price feed for that token. ```solidity contract Handler is Test { ... MockV3Aggregator public ethUsdPriceFeed; ... constructor(DSCEngine _dscEngine, DecentralizedStableCoin _dsc) { dsce = _dscEngine; dsc = _dsc; address[] memory collateralTokens = dsce.getCollateralTokens(); weth = ERC20Mock(collateralTokens[0]); wbtc = ERC20Mock(collateralTokens[1]); ethUsdPriceFeed = MockV3Aggregator(dsce.getCollateralTokenPriceFeed(address(weth))); } ... } ``` With this price feed, we can not write a new function which, when called, will update the collateral price, making the calls to our protocol much more dynamic. ```solidity function updateCollateralPrice(uint96 newPrice) public { int256 newPriceInt = int256(uint256(newPrice)); ethUsdPriceFeed.updateAnswer(newPriceInt); } ``` With this new function, our test runs will intermittently change the price of our weth collateral as functions are randomly called. Let's run it! ```bash forge test --mt invariant_ProtocolTotalSupplyLessThanCollateralValue -vvvv ```  Our assertion is breaking! If we look more closely at the trace of executions we can obtain a clearer understanding of what actually happened:  When updateCollateralPrice was called, the price was updated to a number so low as to break our invariant! The minted DSC was not longer collateralized by the weth which had been deposited. This is legitimately a concerning vulnerability of this protocol. Effectively, if the USD value of our deposited collateral tanks too quickly, the protocol will become under-collateralized. Because we've declared our thresholds as a LIQUIDATION_THRESHOLD of 50 and a LIQUIDATION_BONUS of 10, we're defining our protocol's safe operational parameters as being between 200% and 110% over-collateralization. Too rapid a change in the value of our collateral jeopardizes this range. ### Wrap Up So, we've uncovered a potentially critical vulnerability in this protocol. Either we would go back and adjust the code to account for this, or a developer would accept this as a known bug in hopes that prices are more stable than what our tests imply. These are the types of scenarios that invariant tests are incredible at spotting. For now, I'm going to comment out our updateCollateralPrice function. So that it won't affect our future tests. ```solidity // THIS BREAKS OUR INVARIANT TEST SUITE!!! // function updateCollateralPrice(uint96 newPrice) public { // int256 newPriceInt = int256(uint256(newPrice)); // ethUsdPriceFeed.updateAnswer(newPriceInt); // } ``` We're almost done with this section! There are 3 more things we should cover: 1. Proper oracle use 2. Writing more tests 3. Smart Contract Audit Preparation The finish line is close, let's keep going!

Follow along the course with this video.

Handler - Price Feed

Our handler looks great at this point, but it doesn't reflect everything. Another powerful feature of this methodology is that we're able to leverage our handler to guide not only our target contract, but any contract we want!

Take price feeds for example. These are external references that our protocol depends upon to function properly. We can use our handler to more realistically emulate how price feeds would behave in real-world scenarios.

Our project should already contain a MockV3Aggregator within the mocks folder, so let's begin by importing it into Handler.t.sol. This file mimics the behaviour of a price feed.

Then, we can declare a state variable, and in our constructor, we can employ another getter function to acquire the price feed for that token.

With this price feed, we can not write a new function which, when called, will update the collateral price, making the calls to our protocol much more dynamic.

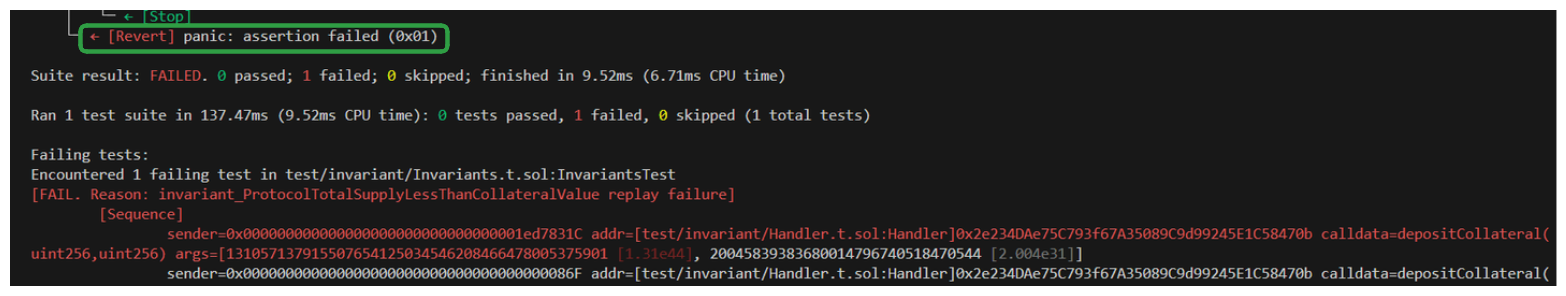

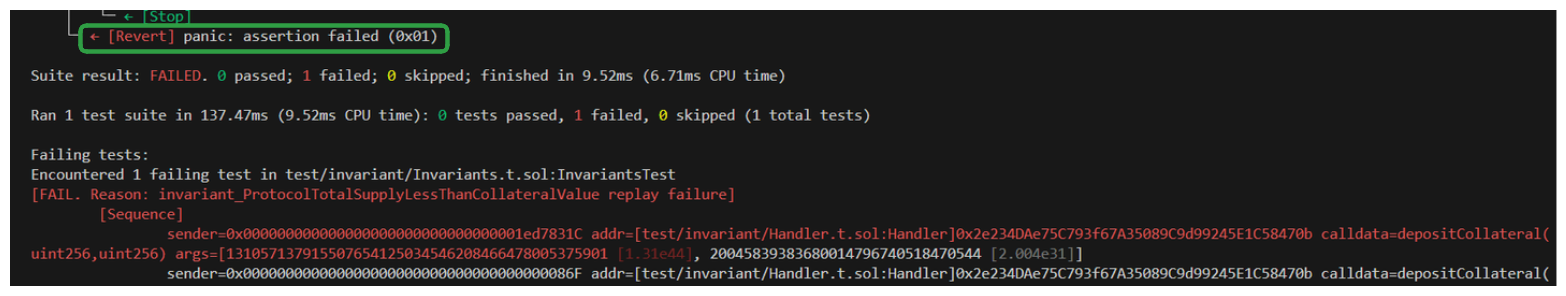

With this new function, our test runs will intermittently change the price of our weth collateral as functions are randomly called. Let's run it!

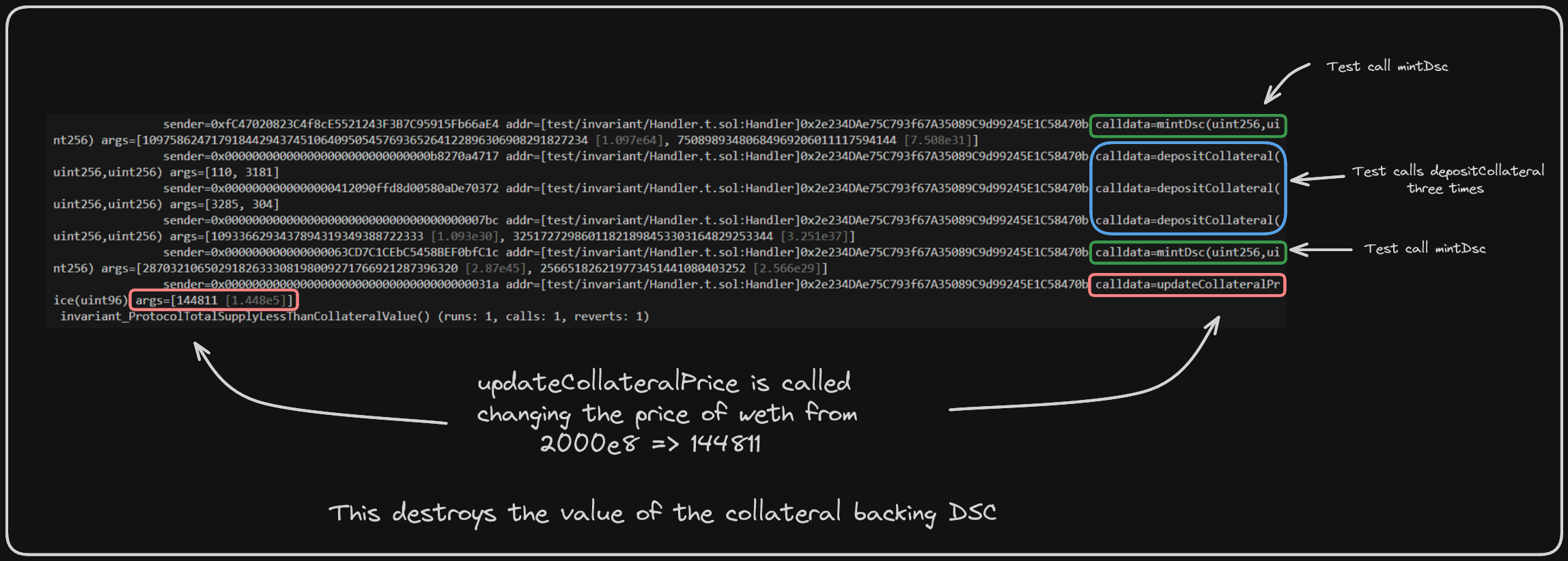

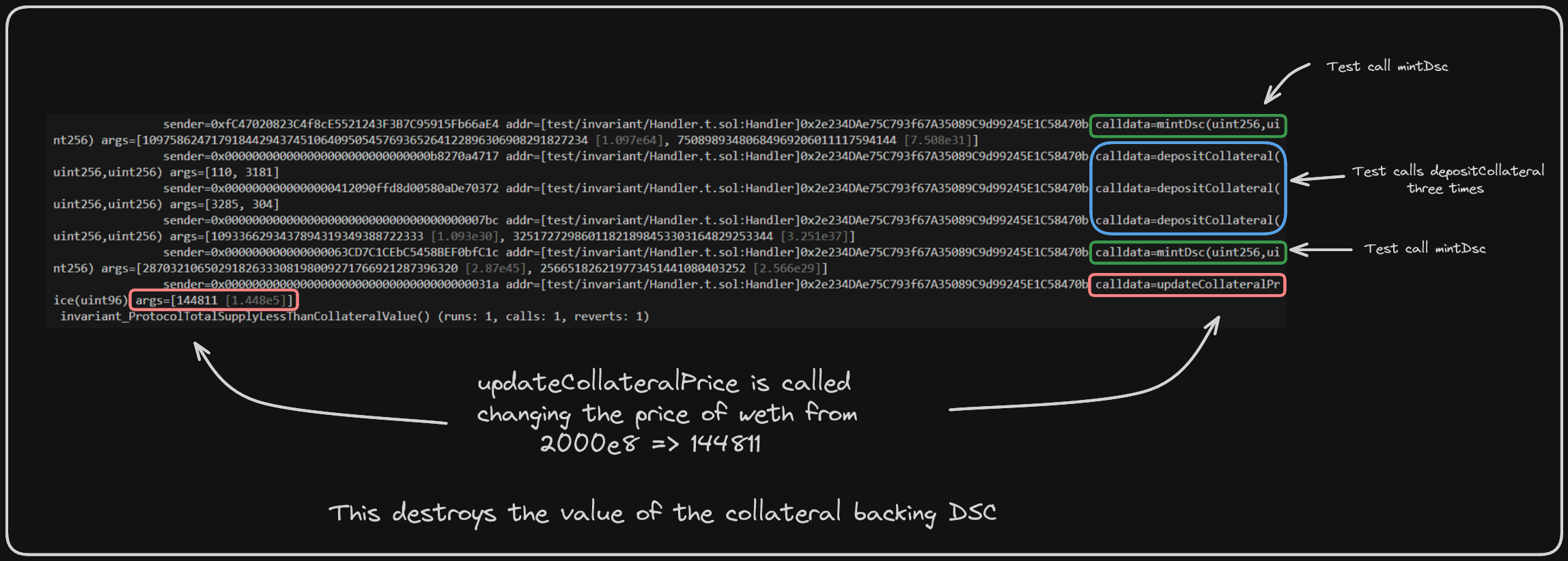

Our assertion is breaking! If we look more closely at the trace of executions we can obtain a clearer understanding of what actually happened:

When updateCollateralPrice was called, the price was updated to a number so low as to break our invariant! The minted DSC was not longer collateralized by the weth which had been deposited.

This is legitimately a concerning vulnerability of this protocol. Effectively, if the USD value of our deposited collateral tanks too quickly, the protocol will become under-collateralized.

Because we've declared our thresholds as a LIQUIDATION_THRESHOLD of 50 and a LIQUIDATION_BONUS of 10, we're defining our protocol's safe operational parameters as being between 200% and 110% over-collateralization. Too rapid a change in the value of our collateral jeopardizes this range.

Wrap Up

So, we've uncovered a potentially critical vulnerability in this protocol. Either we would go back and adjust the code to account for this, or a developer would accept this as a known bug in hopes that prices are more stable than what our tests imply.

These are the types of scenarios that invariant tests are incredible at spotting.

For now, I'm going to comment out our updateCollateralPrice function. So that it won't affect our future tests.

We're almost done with this section! There are 3 more things we should cover:

Proper oracle use

Writing more tests

Smart Contract Audit Preparation

The finish line is close, let's keep going!

Create the Price Feed Handler

An essential guide to OracleLib for Stale Price Checks - Explore the critical risks of using stale oracle data in DeFi protocols and understand how `OracleLib` mitigates them. Learn to implement this Solidity library to wrap Chainlink calls, enforce freshness via timeouts, and halt operations safely when prices are outdated.

Previous lesson

Previous

Next lesson

Next

Course Overview

About the course

What you'll learn

Advanced smart contract development

How to develop a stablecoin

How to develop a DeFi protocol

How to develop a DAO

Advanced smart contracts testing

Fuzz testing

Manual verification

Course Description

Who is this course for?

- Engineers

- Smart Contract Security researchers

Potential Careers

Web3 Developer Relations

$85,000 - $125,000 (avg. salary)

Web3 developer

$60,000 - $150,000 (avg. salary)

Smart Contract Engineer

$100,000 - $150,000 (avg. salary)

Smart Contract Auditor

$100,000 - $200,000 (avg. salary)

Security researcher

$49,999 - $120,000 (avg. salary)

Meet your instructors

Web3 engineer, educator, and Cyfrin co-founder. Patrick's smart contract development and security courses have helped hundreds of thousands of engineers kickstarting their careers into web3.

Guest lecturers:

Last updated on February 17, 2026

Duration: 37min

Duration: 3h 06min

Duration: 5h 03min

Duration: 6h 22min

Duration: 2h 48min

Duration: 1h 24min

Duration: 4h 28min

Duration: 1h 20min

Duration: 1h 11min

Course Overview

About the course

What you'll learn

Advanced smart contract development

How to develop a stablecoin

How to develop a DeFi protocol

How to develop a DAO

Advanced smart contracts testing

Fuzz testing

Manual verification

Course Description

Who is this course for?

- Engineers

- Smart Contract Security researchers

Potential Careers

Web3 Developer Relations

$85,000 - $125,000 (avg. salary)

Web3 developer

$60,000 - $150,000 (avg. salary)

Smart Contract Engineer

$100,000 - $150,000 (avg. salary)

Smart Contract Auditor

$100,000 - $200,000 (avg. salary)

Security researcher

$49,999 - $120,000 (avg. salary)

Meet your instructors

Web3 engineer, educator, and Cyfrin co-founder. Patrick's smart contract development and security courses have helped hundreds of thousands of engineers kickstarting their careers into web3.

Guest lecturers:

Last updated on February 17, 2026