# Chainlink Oracles Overview ## What is Chainlink? Chainlink is a decentralized oracle network (DON) that provides smart contracts with off-chain and cross-chain data and computations in a reliable, secure, and decentralized manner. It was created to solve the “oracle problem,” which refers to the challenge of getting off-chain data into a blockchain in a secure, trust-minimized, scalable, and decentralized manner, as we learned in the previous lesson. Chainlink does this using a similar model to a blockchain–there is a decentralized network of independent operators (oracle nodes) that retrieve data from multiple sources. This data is then aggregated, and a single aggregated data point is delivered on-chain.  Chainlink has become the most widely used DON because it addresses the key challenges of connecting blockchains to external information: ### 1. The Trust Problem **Challenge**: How can a blockchain trust information from the outside world? **Chainlink's Solution**: Instead of relying on a single source of information, Chainlink uses a network of independent operators (called **nodes**) that each collects data. These nodes compare their findings and reach consensus on the correct answer. These nodes work together to form the Chainlink Decentralized Oracle Network, referred to as the DON. **Analogy**: Rather than trusting a single weather reporter, imagine getting weather reports from 10 different meteorologists and going with what the majority says. ### 2. The Accuracy Problem **Challenge**: How can we ensure the data is accurate? **Chainlink's Solution**: Chainlink carefully selects data sources, verifies the reputation of nodes, and uses cryptographic signatures to prove who provided what information. **Analogy**: Like checking a journalist's sources and past reporting history before trusting their news story. ### 3. The Reliability Problem **Challenge**: What happens if a data source goes down? **Chainlink's Solution**: By using multiple independent nodes and data sources, Chainlink ensures the system keeps running even if some participants fail. **Analogy**: If you're waiting for an important package, the postal service doesn't rely on a single delivery person—if someone calls in sick, another carrier covers their route. ## How Chainlink Works **Request**: A smart contract asks for specific information (like the current price of gold or a verifiably random number), computation, or cross-chain communication. **Assignment**: Chainlink selects a group of trusted nodes to fulfill this request. **Data Collection**: Each node independently gathers the requested information from reliable sources. **Consensus**: The nodes compare their answers and agree on the correct value. **Delivery**: The verified information is delivered back to the smart contract. **Payment**: The nodes receive LINK tokens (Chainlink's cryptocurrency) as payment for their service. ## Chainlink Services ### Data and Price Feeds **What they do**: Provide data on-chain, such as price information for cryptocurrencies, commodities, foreign exchange rates, etc. **How they work**: Networks of nodes collect price data from multiple exchanges and data providers, then aggregate them to determine the most accurate price at a certain time interval or when certain conditions are met. **Real-world use**: When you use a DeFi platform that needs to know the current ETH/USD price, it's likely using Chainlink Price Feeds. ### Automation (formerly Keepers) **What it does**: Allows smart contracts to be automatically triggered when certain conditions are met. **How it works**: Chainlink nodes monitor conditions and execute functions when predefined criteria are satisfied. **Real-world use**: Automatically liquidating collateral in lending platforms when values drop below required thresholds. ### Cross-Chain Interoperability Protocol (CCIP) **What it does**: Enables secure communication between different blockchains. **How it works**: Creates a way for smart contracts on one blockchain to send messages and tokens to another blockchain in a secure and decentralized way. **Real-world use**: Send tokens from Ethereum to Polygon or have a smart contract on one chain trigger an action on another chain. ### Chainlink Functions **What it does**: Allows developers to run custom computations off-chain and bring the results onto the blockchain. **How it works**: Executes custom code in a secure environment and delivers verified results to smart contracts. **Real-world use**: Complex calculations that would be too expensive to run directly on the blockchain. **Note**: This is _completely_ separate from the functions on a smart contract. Chainlink Functions is a Chainlink service. To avoid confusion: - If you see the word "Functions" with a capital "F", we are usually referring to the Chainlink service (unless it's the start of a sentance). - Additionally, where possible, it will be prepended with "Chainlink" if we are refferring to the service. ### Verifiable Random Function (VRF) **What it does**: Generates provably fair and verifiable random numbers that cannot be manipulated or predicted. **How it works**: Uses cryptographic techniques to create random numbers that come with proof they were generated fairly. **Real-world use**: NFT projects use VRF to fairly distribute random traits or select winners for giveaways. ### Data Streams **What it does**: Provide on-demand access to high-frequency, low-latency market data, delivered off-chain and verifiable on-chain. **How it works**: Data streams use a pull-based design that supports sub-second data resolution for latency-sensitive use cases by retrieving data only when needed. **Real-world use**: High-frequency price updates for apps like predictions markets that enable participants to react quickly to events and provide accurate settlements. ### Proof of Reserve **What it does**: Verifies that tokenized assets (like stablecoins) are actually backed by real-world reserves. **How it works**: Regularly checks and confirms that the claimed backing assets exist in the reported amounts. **Real-world use**: Stablecoin issuers can prove they have the money backing their tokens. ### DeFi (Decentralized Finance) **Price Feeds**: Most major lending and trading platforms use Chainlink to get accurate price information for cryptocurrencies and other assets. **Example**: When you take out a crypto loan on Aave or trade on Uniswap, Chainlink price feeds help determine fair values and prevent exploitation. ### Gaming **Verifiable Randomness**: Chainlink provides unpredictable, tamper-proof random numbers for fair gameplay and NFT distribution. **Example**: When a game needs to randomly select a winner or distribute random traits to NFT characters, Chainlink ensures no one can manipulate the outcome. ## The LINK Token: Fueling the Network The LINK token is Chainlink's cryptocurrency that serves several important functions: **Payment**: Chainlink node operators receive LINK tokens as payment for providing data services. **Security Deposit**: Nodes often need to stake LINK tokens as collateral, giving them skin in the game to be honest.

Chainlink Oracles Overview

What is Chainlink?

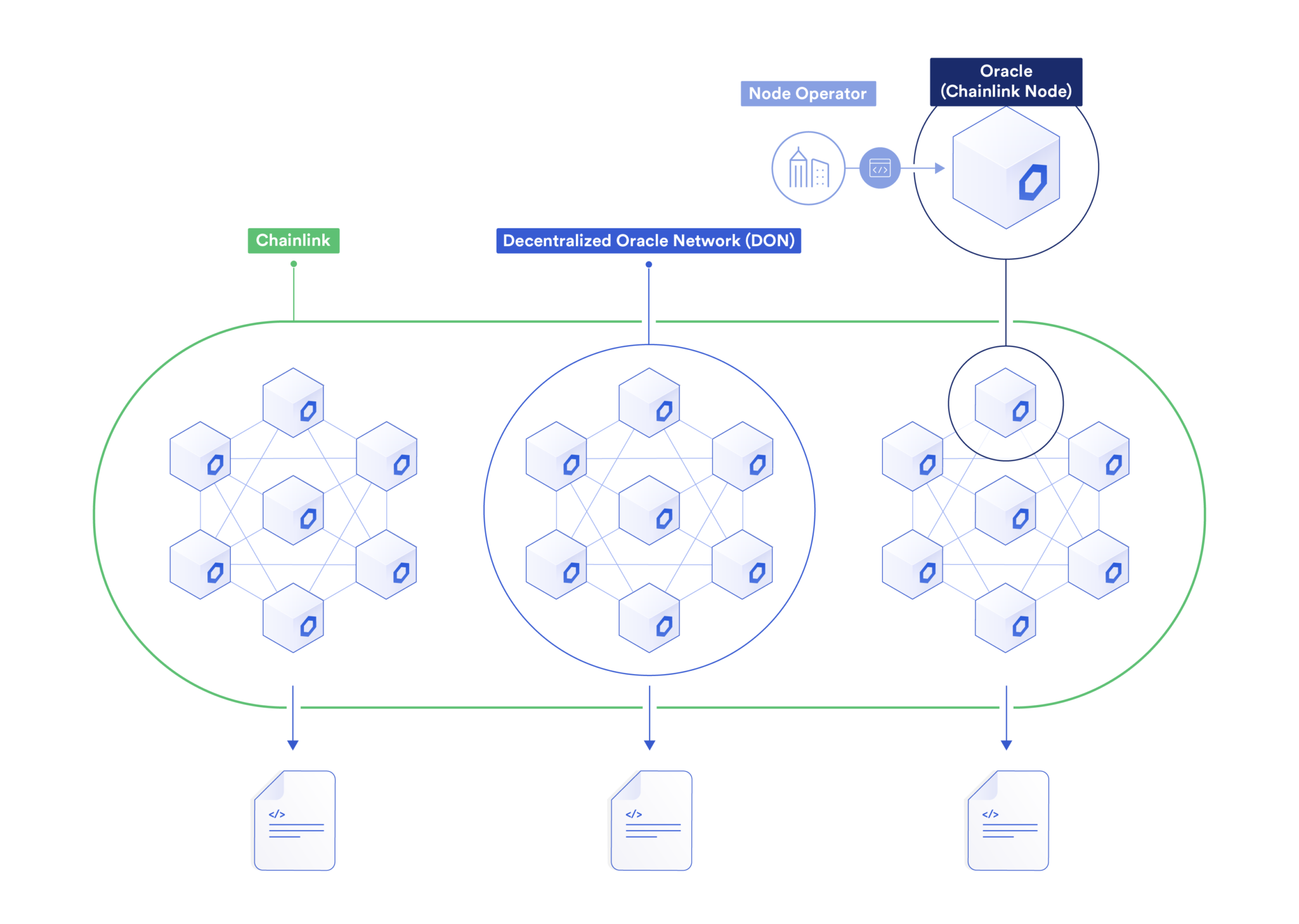

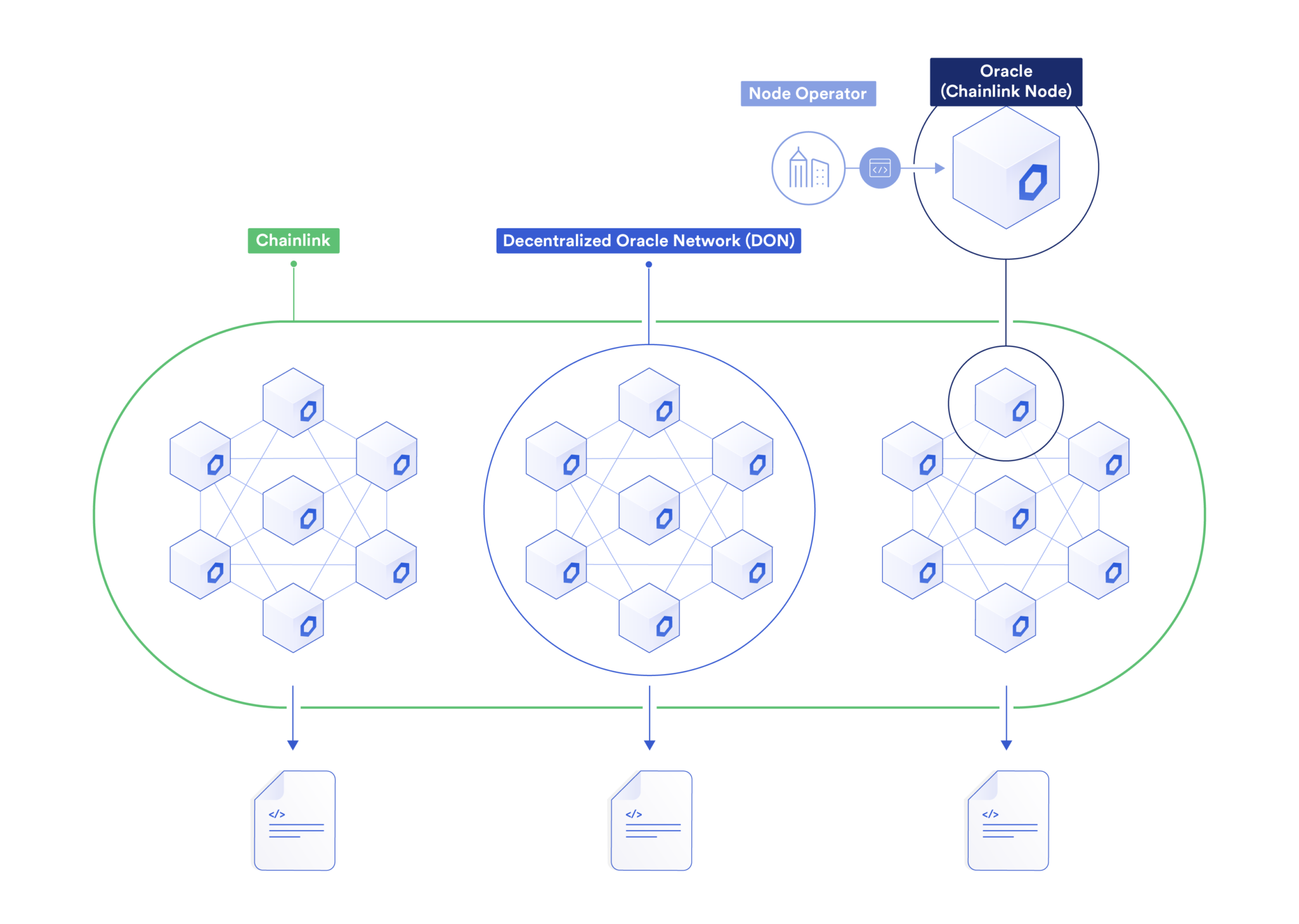

Chainlink is a decentralized oracle network (DON) that provides smart contracts with off-chain and cross-chain data and computations in a reliable, secure, and decentralized manner. It was created to solve the “oracle problem,” which refers to the challenge of getting off-chain data into a blockchain in a secure, trust-minimized, scalable, and decentralized manner, as we learned in the previous lesson.

Chainlink does this using a similar model to a blockchain–there is a decentralized network of independent operators (oracle nodes) that retrieve data from multiple sources. This data is then aggregated, and a single aggregated data point is delivered on-chain.

Chainlink has become the most widely used DON because it addresses the key challenges of connecting blockchains to external information:

1. The Trust Problem

Challenge: How can a blockchain trust information from the outside world?

Chainlink's Solution: Instead of relying on a single source of information, Chainlink uses a network of independent operators (called nodes) that each collects data. These nodes compare their findings and reach consensus on the correct answer. These nodes work together to form the Chainlink Decentralized Oracle Network, referred to as the DON.

Analogy: Rather than trusting a single weather reporter, imagine getting weather reports from 10 different meteorologists and going with what the majority says.

2. The Accuracy Problem

Challenge: How can we ensure the data is accurate?

Chainlink's Solution: Chainlink carefully selects data sources, verifies the reputation of nodes, and uses cryptographic signatures to prove who provided what information.

Analogy: Like checking a journalist's sources and past reporting history before trusting their news story.

3. The Reliability Problem

Challenge: What happens if a data source goes down?

Chainlink's Solution: By using multiple independent nodes and data sources, Chainlink ensures the system keeps running even if some participants fail.

Analogy: If you're waiting for an important package, the postal service doesn't rely on a single delivery person—if someone calls in sick, another carrier covers their route.

How Chainlink Works

Request: A smart contract asks for specific information (like the current price of gold or a verifiably random number), computation, or cross-chain communication.

Assignment: Chainlink selects a group of trusted nodes to fulfill this request.

Data Collection: Each node independently gathers the requested information from reliable sources.

Consensus: The nodes compare their answers and agree on the correct value.

Delivery: The verified information is delivered back to the smart contract.

Payment: The nodes receive LINK tokens (Chainlink's cryptocurrency) as payment for their service.

Chainlink Services

Data and Price Feeds

What they do: Provide data on-chain, such as price information for cryptocurrencies, commodities, foreign exchange rates, etc.

How they work: Networks of nodes collect price data from multiple exchanges and data providers, then aggregate them to determine the most accurate price at a certain time interval or when certain conditions are met.

Real-world use: When you use a DeFi platform that needs to know the current ETH/USD price, it's likely using Chainlink Price Feeds.

Automation (formerly Keepers)

What it does: Allows smart contracts to be automatically triggered when certain conditions are met.

How it works: Chainlink nodes monitor conditions and execute functions when predefined criteria are satisfied.

Real-world use: Automatically liquidating collateral in lending platforms when values drop below required thresholds.

Cross-Chain Interoperability Protocol (CCIP)

What it does: Enables secure communication between different blockchains.

How it works: Creates a way for smart contracts on one blockchain to send messages and tokens to another blockchain in a secure and decentralized way.

Real-world use: Send tokens from Ethereum to Polygon or have a smart contract on one chain trigger an action on another chain.

Chainlink Functions

What it does: Allows developers to run custom computations off-chain and bring the results onto the blockchain.

How it works: Executes custom code in a secure environment and delivers verified results to smart contracts.

Real-world use: Complex calculations that would be too expensive to run directly on the blockchain.

Note: This is completely separate from the functions on a smart contract. Chainlink Functions is a Chainlink service. To avoid confusion:

If you see the word "Functions" with a capital "F", we are usually referring to the Chainlink service (unless it's the start of a sentance).

Additionally, where possible, it will be prepended with "Chainlink" if we are refferring to the service.

Verifiable Random Function (VRF)

What it does: Generates provably fair and verifiable random numbers that cannot be manipulated or predicted.

How it works: Uses cryptographic techniques to create random numbers that come with proof they were generated fairly.

Real-world use: NFT projects use VRF to fairly distribute random traits or select winners for giveaways.

Data Streams

What it does: Provide on-demand access to high-frequency, low-latency market data, delivered off-chain and verifiable on-chain.

How it works: Data streams use a pull-based design that supports sub-second data resolution for latency-sensitive use cases by retrieving data only when needed.

Real-world use: High-frequency price updates for apps like predictions markets that enable participants to react quickly to events and provide accurate settlements.

Proof of Reserve

What it does: Verifies that tokenized assets (like stablecoins) are actually backed by real-world reserves.

How it works: Regularly checks and confirms that the claimed backing assets exist in the reported amounts.

Real-world use: Stablecoin issuers can prove they have the money backing their tokens.

DeFi (Decentralized Finance)

Price Feeds: Most major lending and trading platforms use Chainlink to get accurate price information for cryptocurrencies and other assets.

Example: When you take out a crypto loan on Aave or trade on Uniswap, Chainlink price feeds help determine fair values and prevent exploitation.

Gaming

Verifiable Randomness: Chainlink provides unpredictable, tamper-proof random numbers for fair gameplay and NFT distribution.

Example: When a game needs to randomly select a winner or distribute random traits to NFT characters, Chainlink ensures no one can manipulate the outcome.

The LINK Token: Fueling the Network

The LINK token is Chainlink's cryptocurrency that serves several important functions:

Payment: Chainlink node operators receive LINK tokens as payment for providing data services.

Security Deposit: Nodes often need to stake LINK tokens as collateral, giving them skin in the game to be honest.

Chainlink Oracles Overview

A foundational overview to Chainlink Oracles Overview - Understand what Chainlink is and how its decentralized network solves the oracle problem by addressing trust, accuracy, and reliability. Discover its core architecture, key services like Data Feeds, VRF, and CCIP, and the utility of the LINK token.

Previous lesson

Previous

Next lesson

Next

Course Overview

About the course

What you'll learn

Smart contract and Solidity fundamentals

Chainlink’s decentralized oracle network (DON)

Chainlink Data Feeds

Chainlink Data Streams

Chainlink Automation

Chainlink CCIP

Chainlink Functions

Verifiable Random Function (VRF)

Chainlink Proof of Reserve

Course Description

Who is this course for?

- Smart Contract Developers

- Solutions Architects

- Blockchain Engineers

- Web3 Developers

- Security Researchers

Potential Careers

Smart Contract Engineer

$100,000 - $150,000 (avg. salary)

DeFi Developer

$75,000 - $200,000 (avg. salary)

Web3 developer

$60,000 - $150,000 (avg. salary)

Web3 Developer Relations

$85,000 - $125,000 (avg. salary)

Smart Contract Auditor

$100,000 - $200,000 (avg. salary)

Security researcher

$49,999 - $120,000 (avg. salary)

Blockchain Financial Analyst

$100,000 - $150,000 (avg. salary)

Last updated on July 25, 2025

Duration: 9min

Duration: 1h 17min

Duration: 42min

Duration: 30min

Duration: 1h 03min

Duration: 49min

Duration: 30min

Duration: 19min

Duration: 37min

Duration: 30min

Certification: Chainlink Fundamentals

The Chainlink Fundamentals proficiency exam covers is designed to confirm your grasp of all key concepts and learnings presented in the course material. Exam takers will have 75 minutes to complete 50 questions and must score 30/50 to pass and earn a Certificate of Completion. Because course material is continually updated, The Chainlink Fundamentals Certificate of Completions expires after 1 year. To remain current, holders must re-take the exam and pass to confirm their current knowledge.

Course Overview

About the course

What you'll learn

Smart contract and Solidity fundamentals

Chainlink’s decentralized oracle network (DON)

Chainlink Data Feeds

Chainlink Data Streams

Chainlink Automation

Chainlink CCIP

Chainlink Functions

Verifiable Random Function (VRF)

Chainlink Proof of Reserve

Course Description

Who is this course for?

- Smart Contract Developers

- Solutions Architects

- Blockchain Engineers

- Web3 Developers

- Security Researchers

Potential Careers

Smart Contract Engineer

$100,000 - $150,000 (avg. salary)

DeFi Developer

$75,000 - $200,000 (avg. salary)

Web3 developer

$60,000 - $150,000 (avg. salary)

Web3 Developer Relations

$85,000 - $125,000 (avg. salary)

Smart Contract Auditor

$100,000 - $200,000 (avg. salary)

Security researcher

$49,999 - $120,000 (avg. salary)

Blockchain Financial Analyst

$100,000 - $150,000 (avg. salary)

Last updated on July 25, 2025