_Follow along with this video:_ --- ### MEV - TSwap Ok, so Puppy Raffle wasn't safe - what about TSwap, was there a problem there? Absolutely! Recall from TSwapPool.sol, the deposit function: <details> <summary>TSwapPool.sol::deposit</summary> ```js function deposit( uint256 wethToDeposit, uint256 minimumLiquidityTokensToMint, uint256 maximumPoolTokensToDeposit, uint64 deadline ) external revertIfZero(wethToDeposit) returns (uint256 liquidityTokensToMint) { if (wethToDeposit < MINIMUM_WETH_LIQUIDITY) { revert TSwapPool__WethDepositAmountTooLow( MINIMUM_WETH_LIQUIDITY, wethToDeposit ); } if (totalLiquidityTokenSupply() > 0) { uint256 wethReserves = i_wethToken.balanceOf(address(this)); uint256 poolTokenReserves = i_poolToken.balanceOf(address(this)); // Our invariant says weth, poolTokens, and liquidity tokens must always have the same ratio after the // initial deposit // poolTokens / constant(k) = weth // weth / constant(k) = liquidityTokens // aka... // weth / poolTokens = constant(k) // To make sure this holds, we can make sure the new balance will match the old balance // (wethReserves + wethToDeposit) / (poolTokenReserves + poolTokensToDeposit) = constant(k) // (wethReserves + wethToDeposit) / (poolTokenReserves + poolTokensToDeposit) = // (wethReserves / poolTokenReserves) // // So we can do some elementary math now to figure out poolTokensToDeposit... // (wethReserves + wethToDeposit) = (poolTokenReserves + poolTokensToDeposit) * (wethReserves / poolTokenReserves) // wethReserves + wethToDeposit = poolTokenReserves * (wethReserves / poolTokenReserves) + poolTokensToDeposit * (wethReserves / poolTokenReserves) // wethReserves + wethToDeposit = wethReserves + poolTokensToDeposit * (wethReserves / poolTokenReserves) // wethToDeposit / (wethReserves / poolTokenReserves) = poolTokensToDeposit // (wethToDeposit * poolTokenReserves) / wethReserves = poolTokensToDeposit uint256 poolTokensToDeposit = getPoolTokensToDepositBasedOnWeth( wethToDeposit ); if (maximumPoolTokensToDeposit < poolTokensToDeposit) { revert TSwapPool__MaxPoolTokenDepositTooHigh( maximumPoolTokensToDeposit, poolTokensToDeposit ); } // We do the same thing for liquidity tokens. Similar math. liquidityTokensToMint = (wethToDeposit * totalLiquidityTokenSupply()) / wethReserves; if (liquidityTokensToMint < minimumLiquidityTokensToMint) { revert TSwapPool__MinLiquidityTokensToMintTooLow( minimumLiquidityTokensToMint, liquidityTokensToMint ); } _addLiquidityMintAndTransfer( wethToDeposit, poolTokensToDeposit, liquidityTokensToMint ); } else { // This will be the "initial" funding of the protocol. We are starting from blank here! // We just have them send the tokens in, and we mint liquidity tokens based on the weth _addLiquidityMintAndTransfer( wethToDeposit, maximumPoolTokensToDeposit, wethToDeposit ); liquidityTokensToMint = wethToDeposit; } } ``` </details> We identified, during our review, that the `deadline` parameter wasn't being used. How would that potentially lead to an `MEV` attack in `TSwap`? Before a transaction is sent to the `MemPool`, it is sent to a node. Node operators have privileged information with respect to transactions about to be added to the blockchain and in some circumstances they can delay when a transaction is processed by up to a whole block. If the `deadline` parameter was properly employed it could have prevented this! Imagine a node operator happened to be a `liquidity provider` in `TSwap`. This operator would be able to see pending deposits into the protocol, the practical effect of which would be that their shares and fees are lowered as the `LPTokens` are diluted. This malicious node operator would have the power to delay the processing of this `deposit` transaction in favor of validating more swap transactions maximizing the fees they would obtain from the protocol at the expensive of the new depositor!  ### Wrap Up Oh geez, are _any_ of our previous reviews safe from this massive exploit!? Let's check `Thunder Loan` next!

Follow along with this video:

MEV - TSwap

Ok, so Puppy Raffle wasn't safe - what about TSwap, was there a problem there?

Absolutely! Recall from TSwapPool.sol, the deposit function:

TSwapPool.sol::deposit

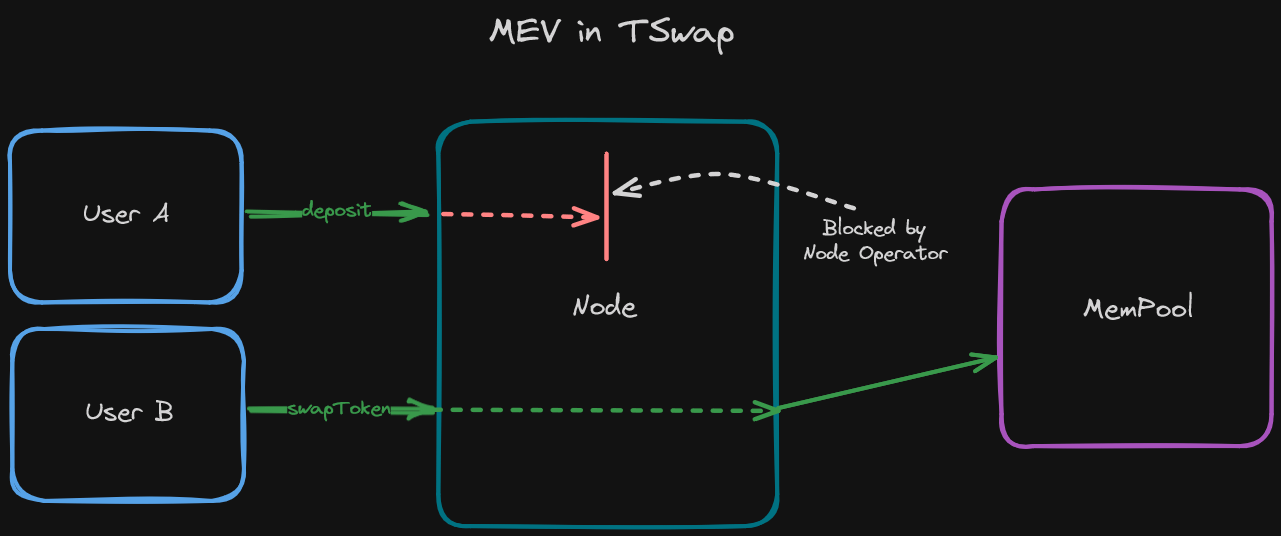

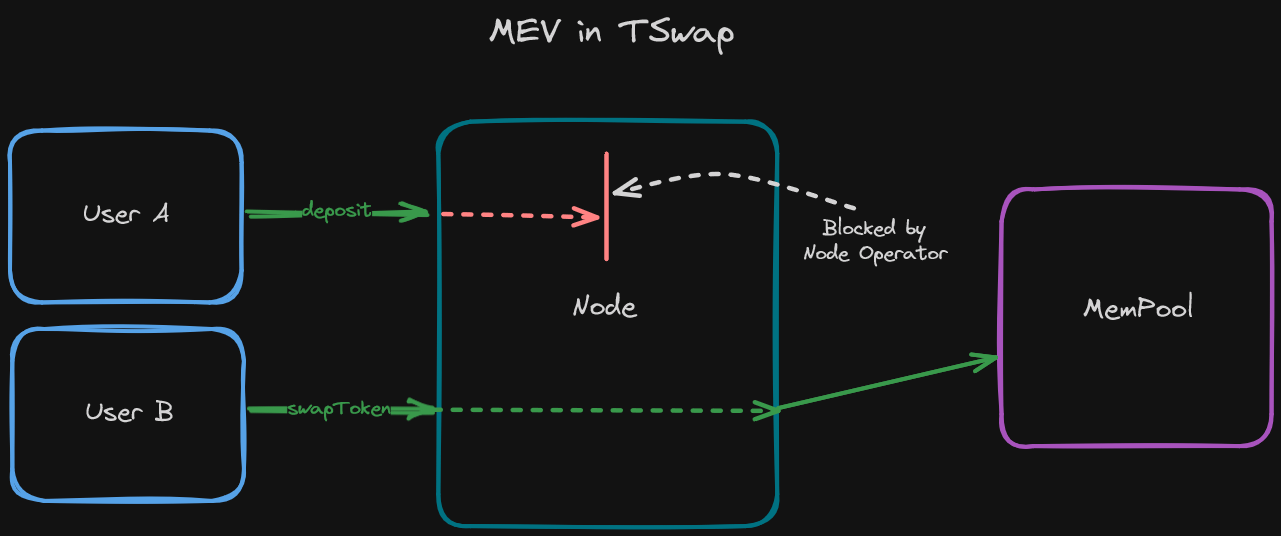

We identified, during our review, that the deadline parameter wasn't being used. How would that potentially lead to an MEV attack in TSwap?

Before a transaction is sent to the MemPool, it is sent to a node. Node operators have privileged information with respect to transactions about to be added to the blockchain and in some circumstances they can delay when a transaction is processed by up to a whole block. If the deadline parameter was properly employed it could have prevented this!

Imagine a node operator happened to be a liquidity provider in TSwap. This operator would be able to see pending deposits into the protocol, the practical effect of which would be that their shares and fees are lowered as the LPTokens are diluted.

This malicious node operator would have the power to delay the processing of this deposit transaction in favor of validating more swap transactions maximizing the fees they would obtain from the protocol at the expensive of the new depositor!

Wrap Up

Oh geez, are any of our previous reviews safe from this massive exploit!?

Let's check Thunder Loan next!

MEV: TSwap

MEV Vulnerabilities in TSwap discussed!

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 30min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min