--- ### Liquidity Providers A natural question that arises from here is: **_Where do funds for the loan initial come from?_** The answer is a familiar one - `Liquidity Providers`! Much like we saw in `TSwap`, where a `Liquidity Provider` would deposit funds into a pool to earn fees, the same takes place with `flash loans`. A `Liquidity Provider` would deposit funds into a `flash loan` protocol, receiving some form of LP Token representative of their contribution. The `flash loan` protocol then accrues fees as people use `flash loans`, which increases the value of a `Liquidity Provider`'s representative allotment of the pool.

Liquidity Providers

A natural question that arises from here is:

Where do funds for the loan initial come from?

The answer is a familiar one - Liquidity Providers!

Much like we saw in TSwap, where a Liquidity Provider would deposit funds into a pool to earn fees, the same takes place with flash loans.

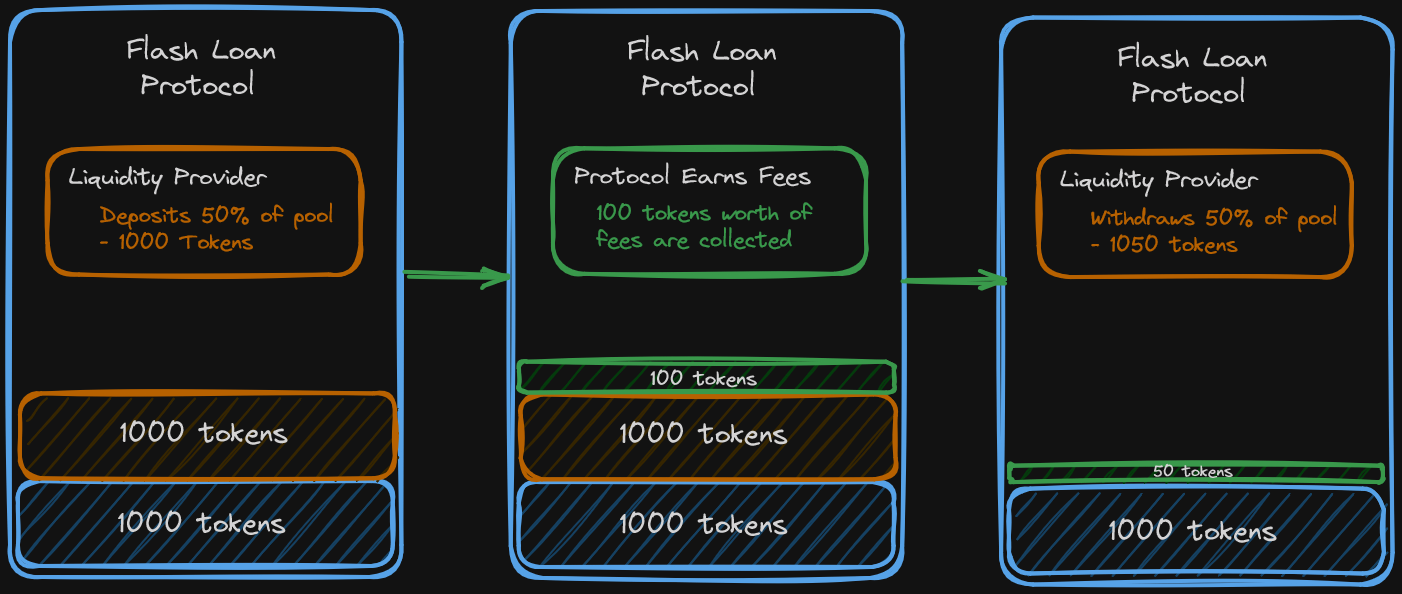

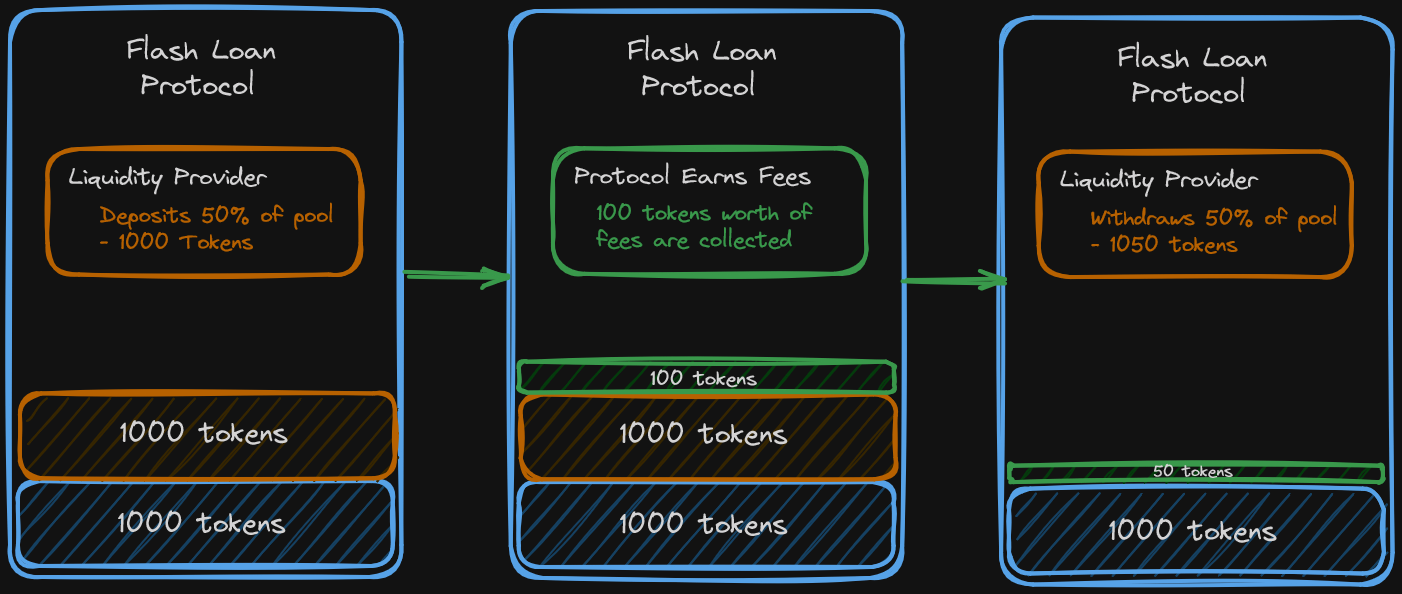

A Liquidity Provider would deposit funds into a flash loan protocol, receiving some form of LP Token representative of their contribution. The flash loan protocol then accrues fees as people use flash loans, which increases the value of a Liquidity Provider's representative allotment of the pool.

Liquidity Providers

Overview - Flash Loans & Liquidity Providers. Emphasis on liquidity providers, flash loans, transaction fees, and benefits for depositors.

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 30min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min