_Follow along with this video:_ --- ### What is a Dex? At it's highest level of abstraction what TSwap aims to do is: Allow users a permissionless way to swap assets between each other at a fair price.  TSwap (based off Uniswap) is an example of a Decentralized Exchange, or a `DEX`. Check out the [**DEXes section of DeFiLlama**](https://defillama.com/protocols/Dexes) for a list of examples! ### What is an Automated Market Maker (AMM)? TSwap is also en example of an Automated Market Maker (AMM). Automated Market Makers are different from a typical "order book" style exchange. Instead of an order book which attempts to match buy and sell orders of users, an AMM leverages `Pools` of an asset. Uniswap is a great example of this. Check out the [**Uniswap Explained video by WhiteboardCrypto**](https://www.youtube.com/watch?v=DLu35sIqVTM) to learn more in depth. In our next lesson, we're going take a closer look at AMMs and how they differ from order book exchanges. Additionally, check out [**this article by Chainlink**](https://chain.link/education-hub/what-is-an-automated-market-maker-amm) for more information on AMMs.

Follow along with this video:

What is a Dex?

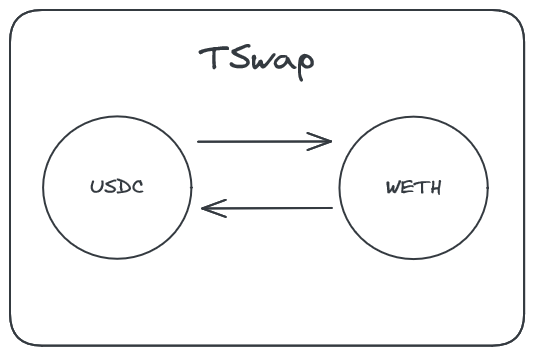

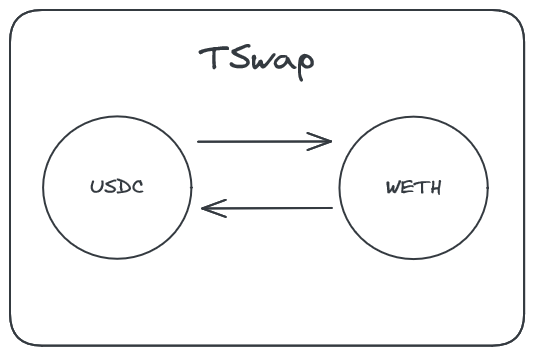

At it's highest level of abstraction what TSwap aims to do is: Allow users a permissionless way to swap assets between each other at a fair price.

TSwap (based off Uniswap) is an example of a Decentralized Exchange, or a DEX.

Check out the DEXes section of DeFiLlama for a list of examples!

What is an Automated Market Maker (AMM)?

TSwap is also en example of an Automated Market Maker (AMM).

Automated Market Makers are different from a typical "order book" style exchange. Instead of an order book which attempts to match buy and sell orders of users, an AMM leverages Pools of an asset. Uniswap is a great example of this. Check out the Uniswap Explained video by WhiteboardCrypto to learn more in depth.

In our next lesson, we're going take a closer look at AMMs and how they differ from order book exchanges.

Additionally, check out this article by Chainlink for more information on AMMs.

What is a DEX?

Decentralized exchanges explained through Uniswap and TSwap

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 30min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min