--- ### Recap It's been a journey, but let's do a quick recap of everything we've covered in this section! 1. Context & Understanding Without much manual review, we were able to construct fuzzing test suites (both stateful and stateless) to identify where these invariants were broken. We experienced first hand how efficient using of tooling and a proper understanding of a protocol can really assist in our reviews in this way. 2. what an AMM/Dex is While gathering context for TSwap we learnt what an automated market maker is, what a decentralized exchange is and their functions within DeFi.  We also covered how AMMs differ from conventional orderbook exchanges and why this adjustment was needed in a blockchain world.  3. Liquidity Providers `Liquidity Providers` add funds to liquidity pools to allow an `AMM` to facilitate trades. We learnt that fees incurred while trading on an `AMM` or `Dex` are used as incentive to pay liquidity providers based on their percentage contribution to the pool! 4. Core Invariants & Constant Product Formula Core invariants are fundamental properties of a protocol that must always hold true. An example of a core invariant was the constant product formula that we saw in TSwap (and is used in Uniswap) `x * y = k`. > **Note:** `x * y = k` effectively says the ratio between these two tokens must remain the same We were also introduced to the [**Properties**](https://github.com/crytic/properties) repo by Trail of Bits, which outlines a tonne of core invariants for common tokens and more. 5. Thoroughly Onboarding a Client This is something we've touched on a few times, but in this section we went through an extension onboarding template and stressed the importance of getting as much information about the protocol from the client as we can. Making note of important details like - Test Coverage - Token/Chain Compatibilities - nSLOC - Scope When we onboard a protocol, we want to ask as many questions as possible to gain as much context as possible. 6. Fuzzing! We learnt how to write `stateful and stateless fuzzing` tests and how powerful they can be in adding value to our audit, catching things our other tools and basic unit tests couldn't hope to identify. 7. FREI-PI/CEI We touched briefly on [**FREI-PI**](https://www.nascent.xyz/idea/youre-writing-require-statements-wrong) as a methodology and the idea of hardcoding invariant checks into smart contract protocols. 8. Tooling In this section we covered some exciting tools extensively. The biggest of which being stateful fuzzing through the foundry framework, of course. We also leveraged tools like [**Slither**](https://github.com/crytic/slither), [**Aderyn**](https://github.com/Cyfrin/aderyn) and [**Solodit**](https://solodit.xyz/) as well as the compiler itself in our hunt for TSwap bugs. In addition to the above, we briefly touched on [**Echidna**](https://github.com/crytic/echidna) and Consensys as fuzz testing alternatives and even Certora - which we'll learn about with formal verification very soon. 9. Weird ERC20s We learnt about the risk associated with `Weird ERC20s` and how prevalent they are in DeFi. These tokens can behave in a wide variety of ways including, but not limited to, re-entrancy, fee-on-transfer, existing behind proxies etc. Being aware of these situations is important. The [**Weird ERC20s GitHub repo**](https://github.com/d-xo/weird-erc20) is an invaluable resources for security researchers and common token types should be something that is studied further. Also check out the [**Token Integration Checklist by Trail of Bits**](https://secure-contracts.com/development-guidelines/token_integration.html) for valuable information on how to protect against these sorts of tokens. 10. More Manual Review! We did another round of manual review resulting in some amazing findings in TSwap such as: - slippage - incorrect fee calculations - lack of deadline checks - fee on transfer ### Wrap Up You deserve a congratulations. If you've made it this far in the course, you're doing incredibly well and are **_already_** very prepared to begin challenging live competitive audits. We've covered so much in this section of the course and you should be incredibly proud. Go take a break and come back for a few extra exercises to bring everything together before you continue into the next section.

Recap

It's been a journey, but let's do a quick recap of everything we've covered in this section!

-

Context & Understanding

Without much manual review, we were able to construct fuzzing test suites (both stateful and stateless) to identify where these invariants were broken.

We experienced first hand how efficient using of tooling and a proper understanding of a protocol can really assist in our reviews in this way.

-

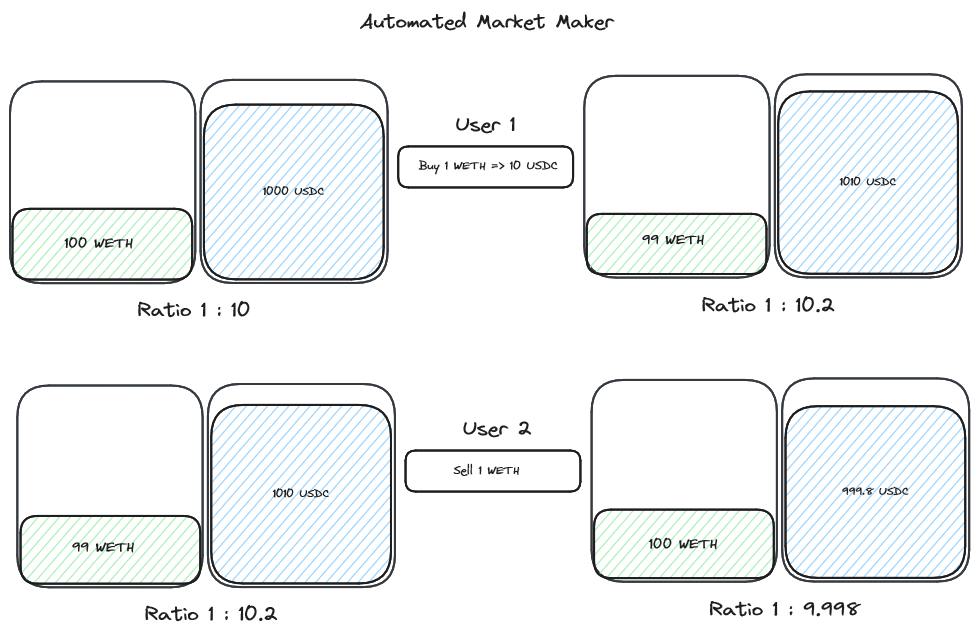

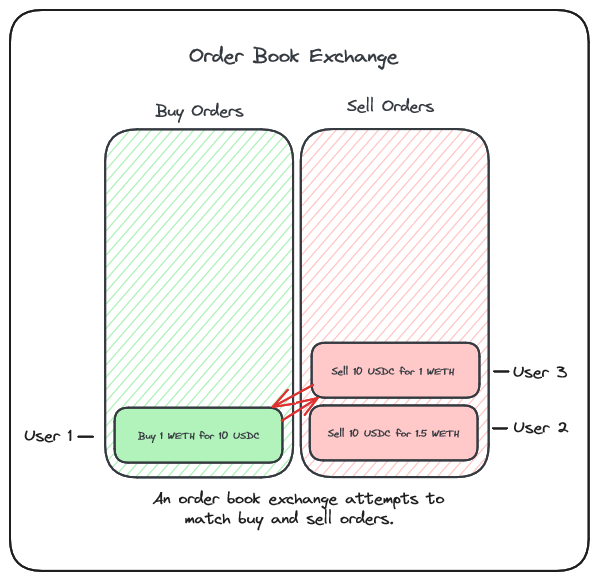

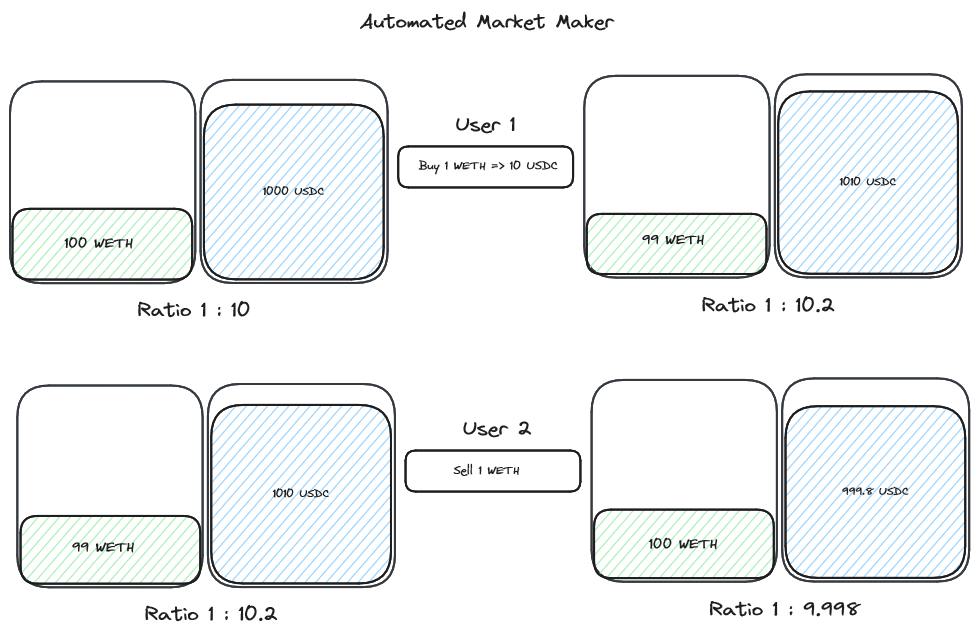

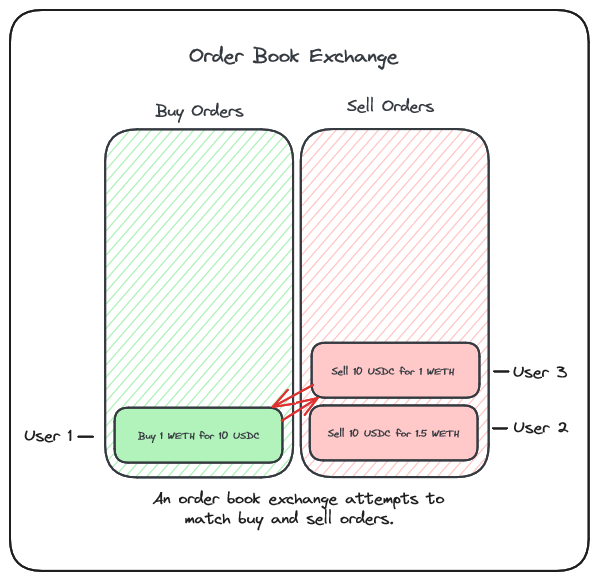

what an AMM/Dex is

While gathering context for TSwap we learnt what an automated market maker is, what a decentralized exchange is and their functions within DeFi.

We also covered how AMMs differ from conventional orderbook exchanges and why this adjustment was needed in a blockchain world.

-

Liquidity Providers

Liquidity Providersadd funds to liquidity pools to allow anAMMto facilitate trades. We learnt that fees incurred while trading on anAMMorDexare used as incentive to pay liquidity providers based on their percentage contribution to the pool! -

Core Invariants & Constant Product Formula

Core invariants are fundamental properties of a protocol that must always hold true. An example of a core invariant was the constant product formula that we saw in TSwap (and is used in Uniswap)

x * y = k.Note:

x * y = keffectively says the ratio between these two tokens must remain the sameWe were also introduced to the Properties repo by Trail of Bits, which outlines a tonne of core invariants for common tokens and more.

-

Thoroughly Onboarding a Client

This is something we've touched on a few times, but in this section we went through an extension onboarding template and stressed the importance of getting as much information about the protocol from the client as we can. Making note of important details like

Test Coverage

Token/Chain Compatibilities

nSLOC

Scope

When we onboard a protocol, we want to ask as many questions as possible to gain as much context as possible.

-

Fuzzing!

We learnt how to write

stateful and stateless fuzzingtests and how powerful they can be in adding value to our audit, catching things our other tools and basic unit tests couldn't hope to identify. -

FREI-PI/CEI

We touched briefly on FREI-PI as a methodology and the idea of hardcoding invariant checks into smart contract protocols.

-

Tooling

In this section we covered some exciting tools extensively. The biggest of which being stateful fuzzing through the foundry framework, of course. We also leveraged tools like Slither, Aderyn and Solodit as well as the compiler itself in our hunt for TSwap bugs.

In addition to the above, we briefly touched on Echidna and Consensys as fuzz testing alternatives and even Certora - which we'll learn about with formal verification very soon.

-

Weird ERC20s

We learnt about the risk associated with

Weird ERC20sand how prevalent they are in DeFi.These tokens can behave in a wide variety of ways including, but not limited to, re-entrancy, fee-on-transfer, existing behind proxies etc. Being aware of these situations is important.

The Weird ERC20s GitHub repo is an invaluable resources for security researchers and common token types should be something that is studied further.

Also check out the Token Integration Checklist by Trail of Bits for valuable information on how to protect against these sorts of tokens.

-

More Manual Review!

We did another round of manual review resulting in some amazing findings in TSwap such as:

slippage

incorrect fee calculations

lack of deadline checks

fee on transfer

Wrap Up

You deserve a congratulations. If you've made it this far in the course, you're doing incredibly well and are already very prepared to begin challenging live competitive audits.

We've covered so much in this section of the course and you should be incredibly proud. Go take a break and come back for a few extra exercises to bring everything together before you continue into the next section.

Recap

Recap things covered in this section. Common issues in DeFi: liquidity, price manipulation, governance attacks.

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 19min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min