--- ### Arbitrage Walkthrough Alright, with a little more context and understanding about flash loans, let's walk through an entire arbitrage process from start to end and see for ourselves how an average user can leverage flash loans to even the playing field in DeFi. We'll start with a poor, average user who can only afford 1 ETH at $5.  His options are pretty limited. How would this look with a flash loan protocol involved? Steps: 1. User recognizes an arbitrage opportunity between two DEXes. 2. User executes a flash loan, using these funds to trade between DEXes 3. User yields a profit of the margin between prices between DEXes 4. User repays flash loan. > **Steps 2-4 happen in a single transaction!**  ### Wrap Up Clearly, DeFi systems like flash loans are incredibly powerful when used to level the playing field of financial opportunity in Web3. In the next lesson, we briefly touch on some contention surrounding flash loans and if they're actually _bad_ or _amoral_. See you there!

Arbitrage Walkthrough

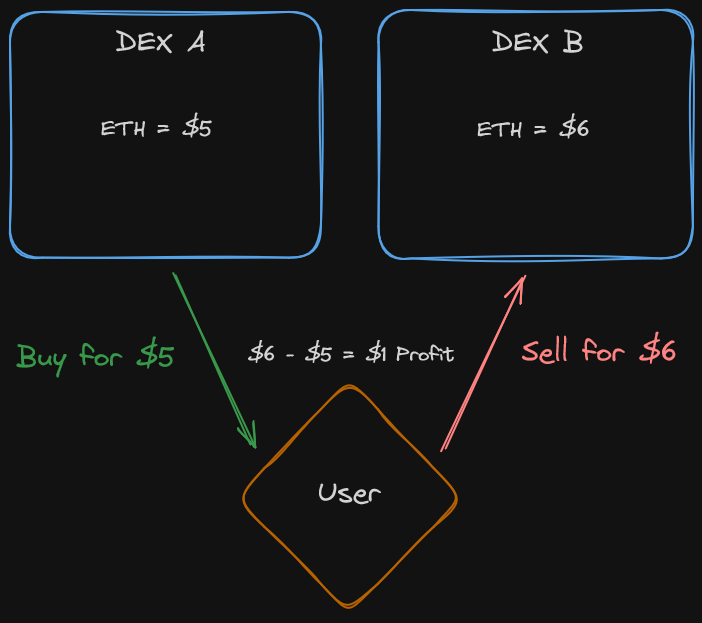

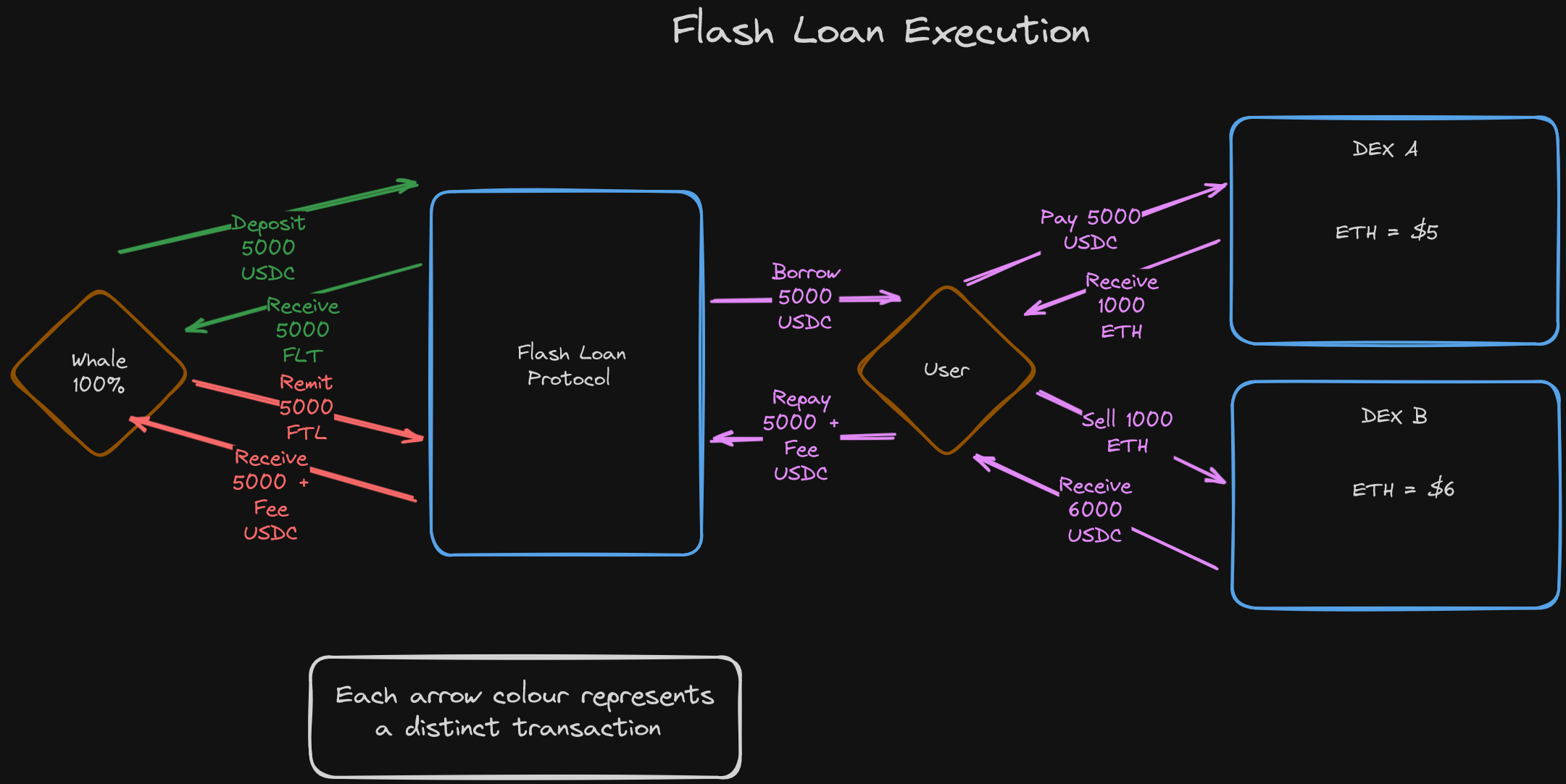

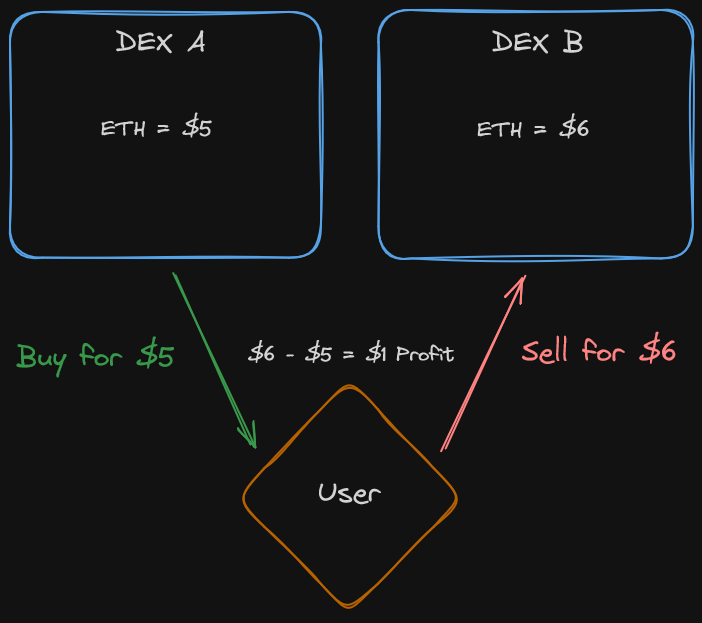

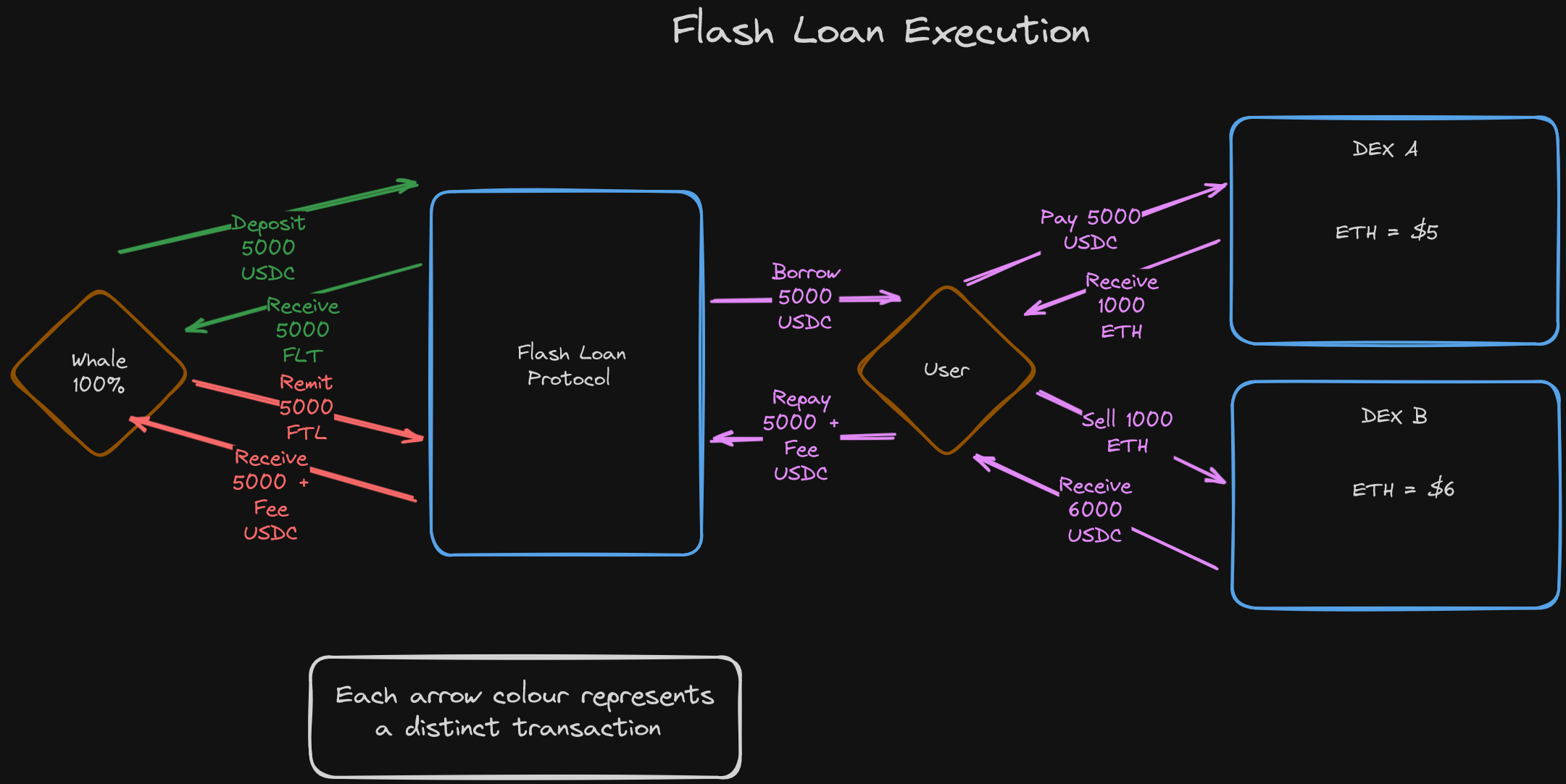

Alright, with a little more context and understanding about flash loans, let's walk through an entire arbitrage process from start to end and see for ourselves how an average user can leverage flash loans to even the playing field in DeFi.

We'll start with a poor, average user who can only afford 1 ETH at $5.

His options are pretty limited. How would this look with a flash loan protocol involved?

Steps:

User recognizes an arbitrage opportunity between two DEXes.

User executes a flash loan, using these funds to trade between DEXes

User yields a profit of the margin between prices between DEXes

User repays flash loan.

Steps 2-4 happen in a single transaction!

Wrap Up

Clearly, DeFi systems like flash loans are incredibly powerful when used to level the playing field of financial opportunity in Web3.

In the next lesson, we briefly touch on some contention surrounding flash loans and if they're actually bad or amoral.

See you there!

Arbitrage Walkthrough

How flash loans enable smaller traders to capitalize on arbitrage opportunities. Covers the significance of single transaction paybacks.

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 19min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min