--- ### Why Flash Loans? The easiest way to understand flash loans may be through an understanding of one of their most common use cases - arbitration. **_What is Arbitrage?_** Let's consider a typical scenario. Suppose there are two DEXs, A and B. On Dex A, the exchange rate for Ethereum stands at $5, and on Dex B, Ethereum is trading at $6. Savvy investors might be quick to see an opportunity for profit. You could buy one Ethereum at DEX A for $5, then head over to DEX B and sell that Ethereum for $6. This simple transaction would net you a profit of $1. This process is known as **Arbitrage.**  Imagine if this situation were to scale up, and you were able to buy 10, 100 or 1000 ETH. The problem lies in the average person's ability to shoulder the upfront investment. In contemporary finance, opportunities like I've outlined above could only maximally be taken advantage of by `whales` aka the incredibly wealthy. This is where flash loans come in to level the playing field in DeFi by giving any user access to much more liquidity - for a single transaction. Let's look at how this works and what a flash loan itself is, in the next lesson. See you there!

Why Flash Loans?

The easiest way to understand flash loans may be through an understanding of one of their most common use cases - arbitration.

What is Arbitrage?

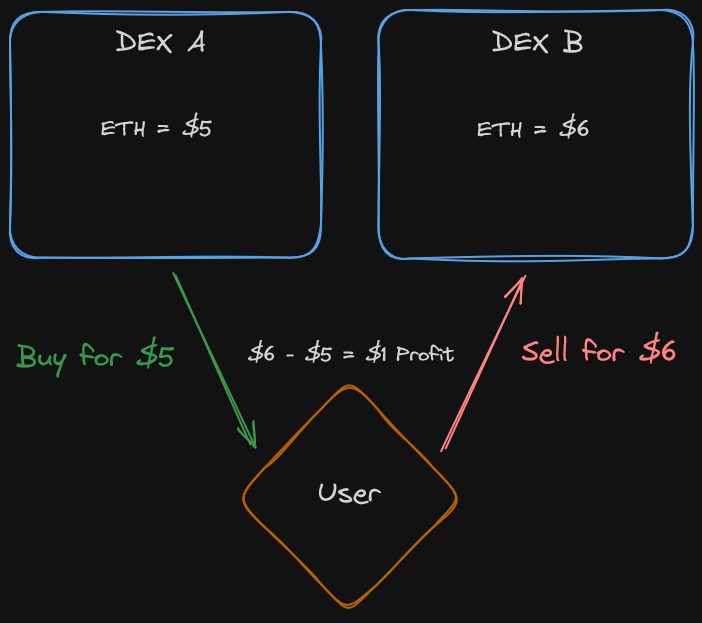

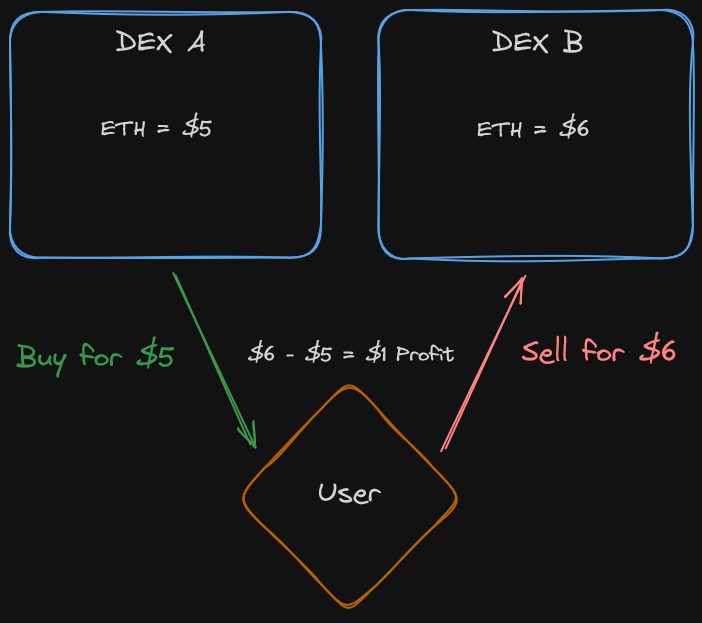

Let's consider a typical scenario. Suppose there are two DEXs, A and B. On Dex A, the exchange rate for Ethereum stands at $5, and on Dex B, Ethereum is trading at $6. Savvy investors might be quick to see an opportunity for profit.

You could buy one Ethereum at DEX A for $5, then head over to DEX B and sell that Ethereum for $6. This simple transaction would net you a profit of $1. This process is known as Arbitrage.

Imagine if this situation were to scale up, and you were able to buy 10, 100 or 1000 ETH. The problem lies in the average person's ability to shoulder the upfront investment.

In contemporary finance, opportunities like I've outlined above could only maximally be taken advantage of by whales aka the incredibly wealthy.

This is where flash loans come in to level the playing field in DeFi by giving any user access to much more liquidity - for a single transaction.

Let's look at how this works and what a flash loan itself is, in the next lesson. See you there!

What is a Flash Loan?

Patrick explains DEX arbitrage using an example and introduces flash loans for Web3 finance.

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 30min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min