### Diagramming Thunder Loan It's at this point in a review that I may begin to diagram out what I currently understand of a protocol. A diagram of Thunder Loan might look something like this:  From what we understand so far, a `liquidity provider` calls `deposit` on the `ThunderLoan` contract passing a token which has an `AssetToken` contract created by the protocol owner at an earlier point. `Thunder Loan` then calculates how many asset tokens to `mint` in exchange for the `deposit` - updates the exchange rate (for some reason) then `mints` the `asset tokens`, closing the transaction off with a `safeTransfer` call to the underlying token, transferring it to the `AssetToken` contract for storage.

Diagramming Thunder Loan

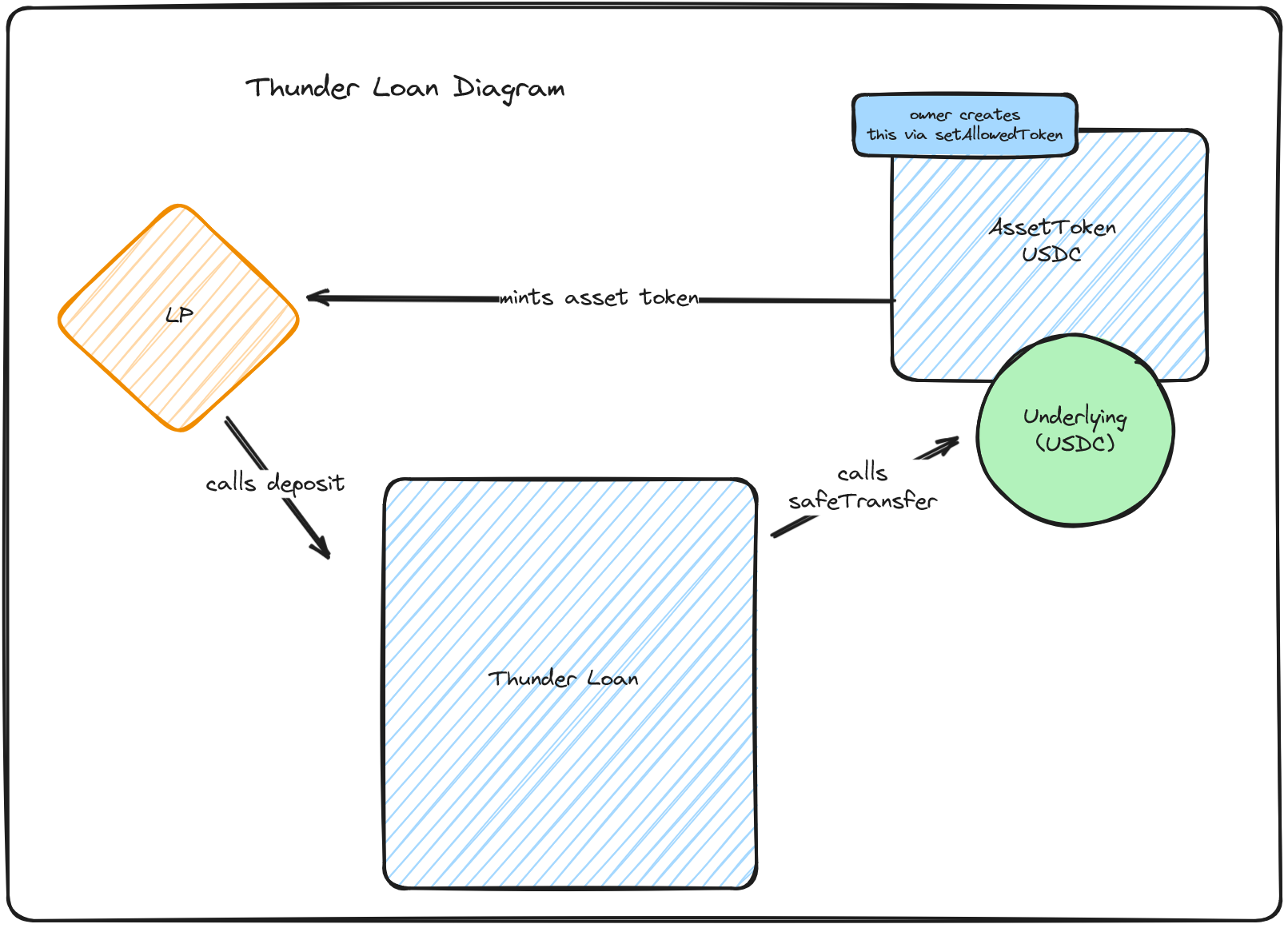

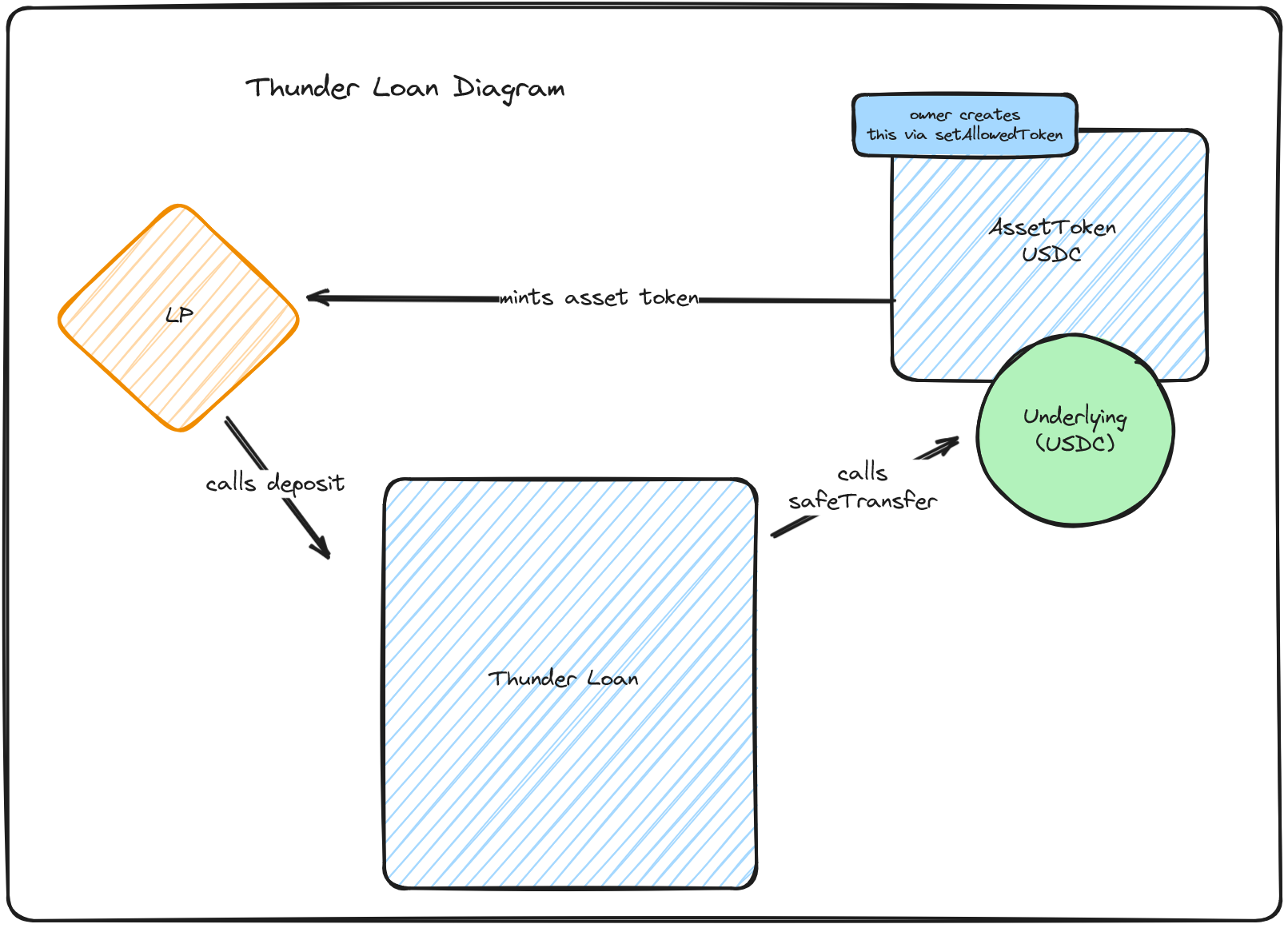

It's at this point in a review that I may begin to diagram out what I currently understand of a protocol. A diagram of Thunder Loan might look something like this:

From what we understand so far, a liquidity provider calls deposit on the ThunderLoan contract passing a token which has an AssetToken contract created by the protocol owner at an earlier point.

Thunder Loan then calculates how many asset tokens to mint in exchange for the deposit - updates the exchange rate (for some reason) then mints the asset tokens, closing the transaction off with a safeTransfer call to the underlying token, transferring it to the AssetToken contract for storage.

Diagramming ThunderLoan

Patrick walks through diagramming Thunder Loan with emphasis on visualization using diagrams for better comprehension.

Previous lesson

Previous

Next lesson

Next

Duration: 25min

Duration: 1h 30min

Duration: 35min

Duration: 2h 28min

Duration: 5h 04min

Duration: 5h 23min

Duration: 4h 33min

Duration: 2h 01min

Duration: 1h 41min